Decred Journal – March 2021

Image: Structural Phasing by @saender

Highlights for March:

- The consensus vote to enable the new treasury system has been approved and should activate around May 7, at which point nodes running software older than v1.6 will be forked off the network.

- v1.6.2 was released in early Apr, it fixes a number of issues with mixing and VSP tickets, as well as improving the stability of SPV nodes, among other improvements.

- The epic migration of Politeia to a new more flexible and scalable storage back-end, which has been in progress for over a year, is finally complete!

- The Decred community have settled on a spirit animal for the project, the majestic Bison!

Contents:

- Fork is Coming

- Development

- People

- Governance

- Network

- Integrations

- Outreach

- Events

- Media

- Community Discussions

- Markets

- Relevant External

Fork is Coming

The consensus vote to enable the new treasury system has passed and the new rules will activate around May 7. Nodes older than v1.6 will stop syncing, so please upgrade to stay on the network. You can track the days remaining here.

The latest release v1.6.2 has fixes for several bugs with VSP staking and mixing, as well as improved SPV operation. See the full release notes and downloads here, and don’t forget to verify them before installing.

Development

The work reported below has the “merged to master” status unless noted otherwise. It means that the work is completed, reviewed, and integrated into the source code that advanced users can build and run, but is not yet available in release binaries for regular users.

Merged in master and the v1.6.2 release:

- only send fast block announcements to full node peers, and don’t send them to lightweight clients that cannot properly handle them. This improves SPV connection stability and, as a result, SPV wallets should need fewer rescans.

Main addition of the month is the new package for handling standard addresses that is easier to follow and use than the code it replaces. It is also more generic, allowing new address types to be added in the future. If you have ever wondered how “scripts” and “addresses” are related, or how “standard” is different from “consensus”, check the shiny new README of the package or follow the examples and comprehensive tests to fully understand how it works. Thanks to all reviewers and welcome to the newcomers - it’s always good to get a fresh pair of eyes!

The new address package, along with the other merged address-related changes are all part of laying some initial groundwork and infrastructure towards future consensus votes.

Other merged work:

- option to not print timestamps in logs

- more accurate detection of own IP address to fix some UPnP configurations

- increased test coverage for

rpcserverand the new UTXO cache

Merged in master and the v1.6.2 release:

- prevent low-fee submissions to the mixing server, which are now being rejected

- fixed UTXO handling to avoid confusing “insufficient balance” errors when the remaining balance is enough to buy one more ticket

- update vote choices for vspd tickets using the

setvotechoicescommand, if the VSP is configured in dcrwallet settings - new

accountunlockedcommand reporting account encryption and locked status (needed for DCRDEX but is also useful in general) - config flag to disable logging to files

Patch release v1.6.2 has fixed several bugs and updated the Decred-patched trezor-connect library.

Merged in master:

- use the new slider component from the pi-ui library

- reorganized balances overview

- List UTXOs view converted to a modal

- improved layout of Trezor-related modals

- project updated to latest Electron 12 and Webpack 5

- ~25 pull requests concluded the 1-year quest to migrate the codebase to a modern React programming style with functional components, hooks, and CSS modules

- increased UI test coverage

- ~11 bug fixes

A total of 53 PRs from 5 contributors were merged, changing 504 files, adding 14.5K and deleting 14.7K lines of code. Without too many user-tangible changes, these large numbers basically mean a lot of “behind-the-scenes” infrastructure upgrades to make future development easier.

In progress: DCRDEX integration and design updates.

An epic migration to a more scalable and flexible storage backend is merged after almost 1 year of development. On a high level it brings us the following:

- scalability - it is no longer constrained to the file system of a single instance

- timestamps and data are separated, allowing to truly censor (and delete) data without awkward trade-offs. Mind that censoring only removes data but not the record proving that the server has seen it, i.e. the “audit trail” is immutable.

- ability to retrieve a cryptographic timestamped proof for any piece of data, e.g. a single comment. There was no easy way to do this in the Git backend.

- a proper plugin architecture where plugins can extend generic timestamped “records” with additional functionality, such as comments or ticket voting. Plugins can be turned on and off in a config file without writing code.

- simplified

politeiadAPI politeiawwwAPI rewritten to be generic and application agnostic while plugins handle specialized routes- check the pull request for more details

Backend and frontend changes rewrote much of the Politeia codebase as can be seen from the stats: 51K lines added, 42K deleted, and 474 files changed.

For developers, the v0.2.0 tag marks the last commit that supports the politeiad Git backend, the politeiad v1 API, and much of the politeiawww www/v1 and www/v2 APIs.

Everybody is welcome to join the testing party for the new version at test-proposals2.decred.org.

Other changes:

- trickling mode of the politeiavoter command-line tool was made truly random instead of using random bucketized durations

Short term we’ll be focusing on feature development that took a backseat during these architecture upgrades. Things like proposal updates from the author, launching a Reddit like forum for the community that runs on Politeia, adding informal stakeholder polls, etc.

Long term, the idea is that Politeia becomes a configurable, timestamped data store that can serve as the foundation for all kinds of use cases. (@lukebp)

Release candidate 2 for the upcoming v1.2.0 is out for testing. See the release notes for a full list of bug fixes, improvements and a couple of breaking changes.

Merged in master:

- fixed saving of archived payments

- disable account lookup UI in solo pools where it is not available

--homedirconfig flag renamed to--appdatato be consistent with other software

@matheusd discovered an interesting hack that allows one to implement PTLCs with very little changes to existing LN code built for HTLCs.

PTLCs (Point-Time-Locked-Contracts) is an exciting development in Lightning Network for its potential to address the limitations of HTLCs (Hashed Time-Locked Contracts) used currently, and for the new use cases made possible.

The hack to enable PTLCs was in fact so simple for @matheusd that he was also able to code up an interesting construct called Multi-Redeemer Transaction Tree (MRTTREE) with it, and an offline LN donation/payment prototype on top of that. The system is made of a patched dcrlnd, a PoC server to coordinate MRTTREEs, and a patched Decrediton. The math is explained in an email to the lightning-dev mailing list and a presentation video (offline LN payments demo starts around 15 min mark).

The hack is experimental and needs some serious cryptographic investigation to make sure it is safe. Nevertheless, this work is interesting in the context of LN-powered multi-owner tickets (a better form of ticket splitting), as well as other use cases enabled by MRTTREEs like off-chain donations and crowdfunding. Unlike the HTLC-based construction of MRTTREEs mentioned in the original blog post, the one based on PTLCs does not need a new opcode: the existing Schnorr checksig opcode (or any new ones eventually added) are sufficient to enable it.

You can learn more about Decred’s LN in the recent Decred in Depth with @matheusd, starting at 28 min mark.

- minimum peer count made configurable for servers that want to increase it to provide higher quality mixes

- support LOGFLAGS for more flexible logging

- ability to reset and change the password

- ability to disable account

- allow sorting Your Orders table

- indicate disconnected state

- support account-based encryption and locking for DCR wallets (this will be used by Decrediton to only lock the trading account but not others)

- allow multiple authenticated sessions (to login in different browsers at the same time)

- send most recent fee rate estimate to the client to support SPV clients, improve order estimates and tighten up security

- send raw transaction data to accommodate SPV clients who don’t have a mempool and are in the dark until a contract’s tx is mined (this also makes the process more robust against poor propagation of tx on the network)

- Ethereum simnet harness for testing during development

- foundations for Bitcoin Cash support

- added database versioning and generated historical trading data (volumes, highs and lows, etc)

- updated to use Webpack 5 and other newer modules

- dex.decred.org updated with cool new visuals by @30000fps

A total of 25 PRs from 6 contributors were merged, adding 22K and deleting 9K lines of code.

In progress: Ethereum support, a new registration protocol (more robust + supports fee payments in arbitrary assets), demo Electron integration, and multiple other improvements.

Feedback from Ethereum experts on the swap contracts used is greatly appreciated.

See the v0.2 and v0.3 milestones to track progress of next releases.

In progress:

- showing Politeia proposals

- mixing implementation

- update dcrlibwallet to latest Decred modules and fix sync issues

- new UI for the Send page

- updated UI for Overview and Account pages

- added About page

- added staking and other info to account details page

- tweaked text inputs

- debug page with logs

- start sync on app startup after passphrase is entered

- request passphrase when syncing a restored wallet in order to allow address generation

- code cleanup and bug fixes

In progress: Politeia proposals page and furher UI work.

- limit the amount of addresses allowed in POST requests

- Script Extensions page moved from dcrdocs

- code repository moved to decred org

- license changed to ISC to meet F-Droid requirements

In addition to Google Play and direct APK download, the app is now also available on F-Droid!

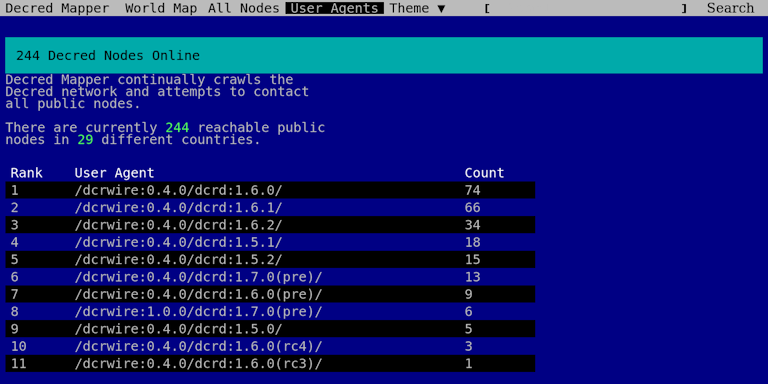

@jholdstock has released a website with a world map of nodes and counts of each user agents. Source code is available here. Testnet version of the site is here. Unix greybeards will enjoy the 386 theme.

@bee has compiled a comprehensive document with all recent knowledge about ticket splitting and v1.6 software. Key takeaways:

- existing ticket splitting solution will work with v1.5.2 software until around May 7, 2021 when it will stop syncing

- everybody agrees ticket splitting is good to have, but there are currently no spare resources to allocate for it, given the low demand (81 split tickets per month is roughly 0.2% of all tickets)

- the lowest hanging fruit is to patch the client to support the new authentication in dcrwallet v1.6

- this is a good opportunity for new developers to get familiar with Decred while making Decred staking more affordable

Other:

- decredpower.com received a ton of new links and design tweaks

- Bug Bounty program reported that it has processed a total of 157 submissions and 15 were eligible for a payout. Congrats to @proabiral who has been listed in the Hall of Fame!

Image: Decred Mapper’s futuristic design

People

Welcome to new first time contributors with code merged to master: @tuhalang (godcr)!

Community stats as of Apr 2:

- Twitter followers: 43,628 (+706)

- Reddit subscribers: 10,797 (+238)

- Matrix #general users: 407 (+25)

- Discord users: 1,409 (-35)

- Telegram users: 2,594 (+76)

- YouTube subscribers: 4,460 (+40), views: 179K (+4K)

- GitHub dcrd stars: 589 (+5), forks: 255 (+3)

Notable activity detected across ~90 tracked accounts:

- main Twitter, Reddit and Telegram had another month of good growth

- CoinGecko got +409 likes (to 9,516) since mid-March when we started tracking it

- @decredproject account on Gab is 11 months old but is still at 7 followers. Any outreach is welcome to help it grow.

- @Checkmate aka “The Machine” gained +1,816 followers (+35%, to 7,042), posting another 1K tweets at ~34 tweets per day

- @PermabullNino gained +398 followers (+13%, to 3,391)

- @ConsensusRough got a surprising +34% followers (to 580)

- @decredbr TG got +6% users (to 384)

- @Decred_ES TW got +5% followers (to 1,365)

- DECRED BRasil FB had a noticeable drop in 30-day posts from ~50 to 19

The above are most notable highlights, but you can see full reports for March and February in a new dedicated place (that can finally fit *all* my numbers – @bee).

Thanks to Decred ambassadors on all platforms for raising awareness about the project!

Governance

In March the Treasury received 11,531 DCR and spent 4,196 DCR - however 3,010 of this was delayed payment for Jan invoices, so the amount paid for Feb invoices was just 1,184 DCR. Using March’s daily average DCR/USD rate of $161.01, this is $1.86M received and $676K spent. The USD figures billed for past work are $135K for Feb (at $113.76) and $163K delayed payments for Jan (at $54.25). As of Apr 4, Treasury balance is 663,658 DCR (124 million USD at $187.04).

Three proposals were published in March.

- The Moderation 2021 proposal estimated a budget of $8,800 (maximum $16,500) for the year, and was approved with 93.4% support and turnout of 36%.

- The Design proposal to cover the remainder of 2021 requests a maximum of $58,850, and reported underspending on the previous proposal such that only 60% of its budget was used. Most of the underspend is associated with the identity and visual communication subdomains. Worklog report for the previous proposal was posted here.

- The video content proposal (phase 3) is up for renewal with a maximum budget of $18,800 for another 6 months, and 2 new contributors (@karamble and @DecredSociety). During the previous phase only 41% of the budget was used.

@bee published a list of all active approved proposals to track the ones expiring soon.

Politeia Digest issue 41 has more details on the month’s proposals.

Network

Hashrate: March’s hashrate opened at ~410 Ph/s and closed ~496 Ph/s, bottoming at 228 Ph/s and peaking at 620 Ph/s throughout the month.

Distribution of hashrate reported by the pools on Apr 1: Antpool 37%, Poolin 29%, F2Pool 10%, Easy2Mine 8%, Luxor 1.3%, BTC.com 1.3%, Coinmine 0.04%, UUPool 0.04%, unknown 13%.

Distribution of 1,000 blocks actually mined before Apr 1: Poolin 30%, Antpool 27%, F2Pool 8%, Easy2Mine 4%, Luxor 2%, BTC.com 1.6%, Coinmine 0.1%, unknown 27%.

Hashrate of the previously top UUPool appears to have migrated to Antpool and F2Pool.

Staking: Ticket price varied between 154.3-221.5 DCR, with 30-day average at 178.0 DCR (-3.7). In the first 3 months of 2021 the ticket price had the highest oscillation since the price algorithm change in 2017, swinging between ~150 and ~220.

The locked amount was 7.10-7.46 million DCR, meaning that 56.0-58.7% of the circulating supply participated in proof-of-stake - again new all-time highs.

VSP: On Apr 1, 6.6K live tickets were held by vspd servers and 4.0K by the legacy dcrstakepool servers. Compared to Mar 1, more than 2.2K tickets have migrated to the new vspd system. Legacy VSPs have reported 11K active and 22K total users. All VSPs together (17 old, 11 new) held 26% of the ticket pool.

Nodes: Throughout March there were around 215 reachable nodes according to dcrextdata.

Node versions as of Apr 1 snapshot (247 total, dcrd only): v1.6.1 - 32%, v1.6.0 - 32%, v1.5.1 - 10%, v1.5.2 - 8%, v1.7 dev builds - 8%, v1.6 dev builds - 6%, v1.5.0 - 2.4%, v1.6.2 - 1.2%.

The share of mixed coins has gradually increased from 39% to 44%. Daily mixed amount varied between 200-350K DCR.

Decred’s Lightning Network has seen 34 nodes (+4), 60 channels (+4) with a total capacity of 20 DCR (+3.2), as of Apr 1.

@Checkmate shared charts showing increased transaction volumes (2021 volume looks even more dramatic when adjusted for circulating supply) and how the share of fees in the total block reward went from 0.01% to 0.12% since October 2020.

@matheusd shared charts of split ticket purchases by month (80 on average, topped at 127 on March 2020) and by the number of participants (4 is most common).

Integrations

decred.raqamiya.net VSP announced that it will be shutting down. As of Apr 5 it had 128 active users and 284 total users, 52 live tickets, and over 20K tickets voted since 2017. The VSP featured a custom UI, email notifications on voted tickets, and 4 voting servers in 3 continents. The home page asks to not buy any new tickets, but live tickets will be supported until all of them are called. Thank you for your service!

CexZ exchange announced the listing of a DCR/BTC pair and came to visit r/decred.

Warning: the authors of the Decred Journal have no idea about the trustworthiness of any of the services above. Please do your own research before trusting your personal information or assets to any entity.

Outreach

A new bison theme has exploded in March, culminating in DCR Bison species getting its own Twitter account specializing in @BisonContent. Most bison research took place in #trading (almost 400 mentions). First mentions date back to 2019 chats about Bison Trails, a New York City blockchain infrastructure company (that happens to offer Decred services now!). But the hype really took off when a stronger link with Decred was found by @Void and @karamble in a 2015 paper titled “Collective decision making during group movements in European bison, Bison bonasus”.

Group coordination and the synchronization of activities are essential to maintain group cohesion during collective movements. Collective decisions arising from this synchronization are influenced by both ecological and sociodemographic factors. (…) The initiator was more likely to be followed if it went in the direction indicated by the majority of individuals, suggesting a voting process.

@DCRann Telegram channel was created to mirror important announcements and reduce dependency on Twitter.

@pavel has shared more insights from running the withDecred.org proposal. In total 11.6 DCR was distributed in 5 rounds. People were quite engaged on Twitter even without being rewarded. Getting people to visit the website was a challenge though, even with sponsored tweets. It is most common for Twitter users to quickly consume and like/retweet if they like the content. With that in mind, site content was boiled down to a giant tweet-storm pinned on the Twitter profile.

Reports from outreach experiments like the one above are appreciated as they help the community to learn what works and what doesn’t, and get better at spreading our message.

Monde PR’s achievements for March:

- created & pitched 2 stories to finance and crypto publications

- responded to 1 request for comment

- secured 1 media interview

News coverage secured by Monde PR:

- @jy-p appeared on the Finance Magnates podcast talking about Bitcoin, blockchain governance, and DCR, syndicated to 4 news outlets including Tech Centry

A reminder for everyone, if you have an awesome tweet or content to share, don’t hesitate to drop it in the #media chat and ask for a retweet via @decredproject.

Image: Bison PoWer

Events

Attended:

- Mar 12-14 - Hackathon Nayarit 2021 - Internet. Decred in Spanish sponsored the hackathon organized by the Ministry of Education of Nayarit. To prepare participants, the Spanish team hosted Blockchain Education training week, consisting of 5 webinars. Hackathon prize pool of $1,000 was divided as follows: $500 for first place, $300 second place and $200 divided among the rest of the 20 participants that presented final projects. After the hackathon a learning session was made for the winners to learn how to use Decrediton, mobile wallets and a general info on how to store and use crypto. It lasted for 3 hours and winners had a chance to ask questions while receiving their prizes. More details here.

- Mar 15 - State of crypto adoption in Morocco - Internet. @arij was invited to an interview with Tony Obiajuru from on #InsideBlockchain at CryptoTvplus where she told about the state of crypto adoption in Morocco, and about Decred and her work with the project.

Media

Selected articles:

- @arij of “cryptocurrency firm Decred” gave commentary to CoinDesk on the state of crypto adoption in Morocco. The article was translated to 4+ languages and went a bit viral in Moroccan electronic news. Governor of the central bank of Morocco commented on the article, saying that they’ve put together a committee for studying crypto and central bank digital currencies to keep up with the innovation, that Bitcoin is not money because it’s speculative and unregulated, but in the end people cannot be stopped from using it. As a follow-up the bank has launched a video discouraging from using Bitcoin because it’s too risky.

- Decred’s v1.6.1 release and “User Activated Hard Fork” to decentralize the treasury have been mentioned in f2pool’s bi-weekly PoW Round-Up Mar-09 and Mar-23 issues

- What is Decred? by Samuel Sherwood (exodus.com)

Videos:

- Matheus Degiovani interview Decred in Depth (live) by @elima_iii (youtube) - new treasury, opcodes, LN and more

- Decred staking tutorial - [2021 updated] by @Exitus (youtube)

- Exploring Decred and on-chain analysis by Real Vision (realvision.com) - an interview with @Checkmate, you can see a free sample on YouTube (mentions the unprecedented reduction of liquid BTC) or the full episode by signing up on the site

- PTLCs, MRTREEs and offline LN payments by @matheusd (youtube)

- Decred News Update - $110M treasury decentralization, on-chain governance voting, network ATH & more by @Exitus (youtube)

- Decred Price Analysis - 24th March 2021 by Josh Olszewicz of Brave New Coin (youtube) - Decred slices and dices!

Audio:

- Decred’s Jake Yocom-Piatt on Bitcoin, blockchain governance, DCR, & more by Rachel McIntosh (youtube, edited text version at financemagnates.com)

Translations:

- Spanish subtitles added to some of the top viewed channel’s videos: How to Stake tutorial, Full Node & Tor on Raspberry Pi, Governance Walkthrough with @Checkmate, Decred Assembly 15 on Decred and ASICs, Feb 14 News Update, and the recent Decred in Depth with @matheusd

- Decred Journal February 2021 was translated to Arabic (@arij, @abdulrahman4), Chinese (@Dominic), and Spanish (@francov_). Thank you all for spreading Decred news!

Community Discussions

Selected Reddit posts:

- odd patterns on the price chart

- a compilation of rough edges in mixed staking with Decrediton v1.6.1 and how to workaround them

- invitation to Twitter poll tournament (and the irony of pitching it to a community obsessed with solid voting tech)

- notes on quantum resistance

- generating media for the latest consensus vote (and challenges of getting the word out)

- March’s last price talk again got pretty intelligent and compared Decred to Python

Selected Twitter discussions:

- @jy-p on going in the opposite direction by creating a fairer opt-in financial system

- @ammarooni suggests to talk more about the USD value locked in tickets because it going above 1 billion is quite an achievement

- @bochinchero has linked the price rally with rising stake participation, voter turnout and mixing activity, and noted that fungibility is strong when massive:

Over 43% of the available $DCR supply is now mixed and unspent. Some argue that opt-in privacy or a transparent ledger can never be truly fungible… I honestly can’t think of a rational actor that would willingly accept a currency, but reject half of the circulating coins. (@TheBochinchero)

Markets

In March DCR was trading between USD 140.16-180.60 / BTC 0.00275-0.00310. The average daily rate was $161.01.

@PermabullNino posted that Decred’s on-chain data is in beast mode, having settled 4x more native units than Bitcoin in February.

@Checkmate has updated his comparison chart of “Lindy Coins” vs Bitcoin as it has rallied from $10K to $58K. DCR continues to stand out.

Relevant External

March’s big DeFi Dumpster Fire was PAID, which was subjected to an infinite minting attack that saw the attacker issue $180 million PAID to themselves, but they were apparently only able to capture $3 million of the value by converting it to something other than rapidly devaluing (down 85% at one stage) PAID tokens. In a postmortem it was explained that the attacker gained access to the private key for the original contract deployer and used it to “upgrade” the contracts so that they could mint new tokens. A snapshot will be used to “reset” the PAID token to wipe out the attacker’s tokens which they were not able to sell before being discovered.

SushiSwap has been dealing with a major dilemma about how to distribute tokens which it owes to liquidity providers from Oct 2020, the tokens had a 6 month “vesting period”, and the question of how to distribute them was raised in Jan 2021. SUSHI holders have already voted against a straight airdrop of the tokens and opted for a claiming mechanism which will cost claimants fees, but then it transpired that the smart contract’s code had been edited so that it could no longer be claimed by users who interacted with it through third party smart contracts (like Harvest.finance, whose users are owed 5-6% of these tokens). The reason given by the developers who deployed this update is concern that “parasitic farms” will dump their token allocations. The latest is that these farms can submit proposals for how to distribute their allocations, for review by the Sushiswap community.

The Cosmos “inter blockchain communication (IBC)” protocol has been approved by Cosmos voters by a whopping majority of 112 million to seventy five, it promises to enable secure communication between blockchains which satisfy certain criteria. As Cosmos is the only blockchain to support this IBC standard it is not currently very useful, but it is likely that other Tendermint based blockchains will add support soon too.

Ethereum’s EIP 1559 has been included in the forthcoming London hard fork, as decided on the Core Developers call on Mar 5. EIP 1559 will fundamentally change how transaction fees are calculated and paid, winning the support of most users and developers by promising to significantly improve the user experience. Miners however have signalled opposition to this change, with over 60% opposing it as it will interfere with one source of revenue for them. Analysis from Hasu suggests that miners will go along with it anyway as they can still earn a good profit from block rewards and Miner Extractable Value (MEV), whereas the alternative can be interpreted as an attack on the network and is likely to damage the ETH price (thus miners’ bottom line).

The UK Tax authority has updated its guidance for the treatment of crypto assets to cover staking for the first time - this is to be treated in the same way as mining income is currently treated, but may open the door for future differentiated treatment.

Privacy advocate @6102bitcoin received a report that Bitstamp Europe asked their user to explain a CoinJoin transaction made with Wasabi wallet soon after withdrawing, and that request was made months after the activity. One reply pointed out that operators are pressured by the governments imposing these rules, such as the French DASP authorization that asks to inspect on-chain hops both ways (inbound and outbound). Earlier Bitstamp made the news for asking a Dutch-based customer to share an unusual amount of personal information, including net worth and annual income, proof of residence, and the origins of fiat and crypto funds.

CoinDesk’s YouTube account got suspended for about 1 day, after what was apparently a mistaken takedown of their channel.

A new method of cashing out cryptocurrency has apparently been popularized in Russia, “buried treasure”, or dead drops of cash to specific coordinates.

About This Issue

This is issue 36 of Decred Journal. Index of all issues, mirrors, and translations is available here.

Most information from third parties is relayed directly from source after a minimal sanity check. The authors of the Decred Journal have no ability to verify all claims. Please beware of scams and do your own research.

You can submit a story here to be considered for the next release. Feedback and contributions are always welcome.

Credits (alphabetical order):

- writing and editing: bee, degeri, l1ndseymm, richardred

- reviews and feedback: arij, davecgh, dnldd, jholdstock, JoeGruff, lukebp, matheusd

- title image: saender

- funding: Decred stakeholders