Decred Journal – December 2022

Image: Bison Relay artwork by @saender

December’s highlights:

- Bison Relay was introduced and launched, this innovative privacy-enhancing and spam-resistant messaging network uses Decred Lightning Network to attach costs to messages and deter spam, and is now open for use.

- The Lightning Network node count and capacity increased significantly following Bison Relay launch, as new users opened channels and started paying for messages.

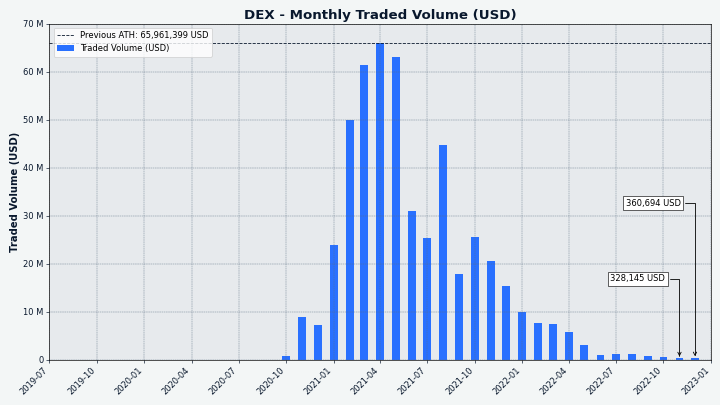

- DCRDEX v0.5.8 was released with new advanced options.

Contents:

- Bison Relay Launch

- DCRDEX v0.5.8 Release

- Development

- People

- Governance

- Network

- Ecosystem

- Outreach

- Events

- Media

- Markets

- Relevant External

Bison Relay Launch

Bison Relay is a new peer to peer social media platform with strong protections against censorship, surveillance and advertising. Messages are end-to-end encrypted to ensure only the intended recipients can see the contents. There are no accounts and metadata is minimized so that server operators cannot see message contents, sender, receiver, or which chats user participates in. Built-in payments allow content monetization via paid content access or tipping.

Initial release comes with the following features (incomplete list):

- Direct chats

- Sending files

- Group chats

- Making longer posts with Markdown and images

- Commenting on posts

- News feed with content from users you are subscribed to

- Relaying posts (reposting)

- Connecting with other users via invite files sent over an existing channel, or via Bison Relay directly (your existing contacts connect you with their contacts, aka mediated key exchange)

- Sending and receiving DCR tips via Decred Lightning Network

- Sharing files with optional price that users pay for access

- Creating and paying invoices

- GUI and command-line apps for Linux, macOS and Windows

Payments for sending and receiving messages serve as anti-spam protection but Bison Relay is cheap to use, 0.1 DCR could last months for regular chatting.

Most users will want to download the GUI app here, get the file named bisonrelay-xxx for your operating system. The downloads have no hashes or signatures yet but those will be added in the future.

Learn how to use Bison Relay:

- Official Features and Tutorial

- 2-min overview in Decred News Update

- Setting up Bison Relay v0.1.1 on macOS

- First look and feature overview of v0.1.1

- News feed - connecting, creating and using markdown

Once set up, read the onboarding guide and contact @kozel on Matrix to get your initial invite(s).

Advanced users can also check the command-line brclient app, server source code, and technical docs.

To understand the motivation behind Bison Relay check the posts by @jy-p:

- Outreach problems Decred faced with existing outlets and social media platforms

- Inherent problems with today’s Web

- Initial Bison Relay announcement explains the high level design of the system and why it was required to facilitate free speech and free association

- Twitter announcement

The inference is that Decred should attempt to grow its network without conventional marketing. The path forward is not through, but around. [What is wrong with Decred?]

DCRDEX v0.5.8 Release

This release fixes issues with requesting fiat rates from external sources, and adds options for advanced command-line and Go API users that allow skipping time consuming operations on startup and shutdown.

v0.5.8 is available as a standalone DEX app here.

Development

The work reported below has the “merged to master” status unless noted otherwise. It means that the work is completed, reviewed, and integrated into the source code that advanced users can build and run, but is not yet available in release binaries for regular users.

dcrd

dcrd is a full node implementation that powers Decred’s peer-to-peer network around the world.

- Always serve known filters when peers ask for it with

getcfilterv2request. Previously, a node would not serve the filters until its chain was fully synced with the network. This limitation was inherited from the old bloom filters logic, where it helped to avoid performance drops, especially during the initial chain sync. The downside is that the node could appear to be unresponsive or stalled in a variety of production and testing scenarios. The bloom filters have been replaced by version 2 filters and they are relatively cheap to serve now, so the node can always respond togetcfilterv2requests, even before the chain is fully synced. - Updated JSON-RPC API documentation for methods used for discovering transactions matching certain criteria:

loadtxfilter,notifynewtransactions, andrescan. Information for removed API methods and notification has been removed. - Smaller changes and cleanup.

dcrwallet

dcrwallet is a wallet server used by command-line and graphical wallet apps.

- Added

--cpuprofileswitch to capture CPU performance data and save it to a file. - Added fetching of new treasury spends in SPV mode. This will be used by Decrediton to enable TSpend voting in more scenarios.

- Modified ticket purchasing logic to support Trezor staking in upcoming changes to Decrediton. This change wires some existing code together, and future changes will focus on ticket upkeep and re-paying failed VSP fees. Staking DCR stored on a Trezor wallet is a much requested feature so here is some background. The combination of signing transactions with Trezor, Decred staking system, and the newer system of delegating ticket votes to Voting Service Providers (VSP), presents a number of challenges. One is that a VSP needs a private key of the voting address to vote with the ticket, but Trezor does not allow to export private keys directly. Another is that Decrediton needs to sign voting preferences for each VSP-managed ticket, but asking Trezor to sign every message is poor UX. To get around these, a piece of private data that can be obtained from Trezor will be used to derive keys for voting and signing vote preferences.

- Updated dependencies for supplementary command-line tools: movefunds, repaircfilters, and sweepaccount.

Decrediton

Decrediton is a full-featured desktop wallet app with integrated voting, StakeShuffle mixing, Lightning Network, DEX trading, and more. It runs with or without a full blockchain (SPV mode).

- Updated DCRDEX module to v0.5.7 which fixes several edge cases around order cancellation.

- Introduced voting for individual TSpends. If any tickets are managed by VSPs, changed ticket vote preferences will be sent to the VSPs. If new unvoted TSpends are detected, a notification will be shown on the home page. Existing voting policies for treasury keys and individual TSpends will be shown on ticket details page.

- Expanded automated UI test coverage.

Image: TSpend voting in Decrediton.

Politeia

Politeia is Decred’s proposal system. It is used to request funding from the Decred treasury.

- Build and test pi-ui against Node 18 and 19.

- Test fixes.

vspd

vspd is server software for running a Voting Service Provider. A VSP votes on behalf of its users 24/7 and cannot steal funds.

- Removed duplicate fee address check that did not scale well (it took almost 500 ms to insert into a 100K ticket database). Duplicate fee addresses have never been observed in development, testing, or production.

DCRDEX

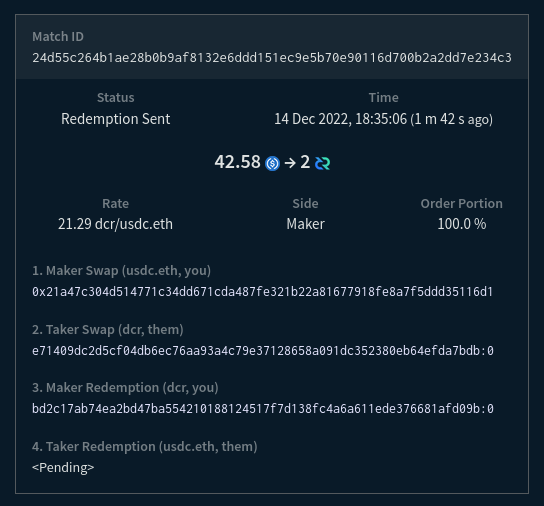

DCRDEX is a non-custodial, privacy-respecting exchange for trustless trading, powered by atomic swaps.

- Added Core API options to skip time consuming operations on startup and shutdown.

NoAutoWalletLockdisables wallet locking on shutdown, which is useful for avoiding a potentially very long unlock operation.NoAutoDBBackupdisables automatic database backups on shutdown.UnlockCoinsOnLogininstructs the wallet to unlock any coins (outputs) locked individually on login or wallet creation, this automates the manual recovery from multiple issues caused by dropped connections and crashes during order placement. These options can also be set using the new switches for thedexccommand-line app, but they are really intended for people writing their own Go code to control the DEX client via theCoreAPI. - Fixed handling of failed fiat rates requests to external services, and adjusted their frequency to avoid hitting rate limits.

Changes below are merged in master towards future releases.

Ethereum:

- Added client and server support for swaps with testnet USDC.

- Added ability for DEX client and server to connect over authenticated WebSocket to a Geth full node. This allows users to run Geth on a separate machine.

Fidelity bonds (client):

- Third batch of fidelity bonds implementation was merged, building on the lower-level API and server code added in October and November. This batch adds internal client code to create, store, post, confirm, and refund the bonds, as well as

dexcapp command for posting bond from the command line. Bonds implementaion was split into phases to make review feasible and progress in parallel with multiple other developments. Up next is account tier maintenance, bond renewal, settings, and UI components. - Documented bonds in the spec.

- For a recap, time-locked fidelity bonds will replace the current registration fee system. Users will lock coins in bonds and gain permissions to trade, as long as their bond tier is high enough (possibly compensating for poor trading behavior like cancelling orders too much). When trading access is no longer needed the bond can be redeemed to get the coins back. The bonds system is a prerequisite for building a server mesh.

Other client changes:

- Refactored login sequence to better handle multiple login attempts and avoid repeating intialization steps. Added a warning prompting to unlock the wallets ASAP to process active trades.

- Refactored fee estimation common for Bitcoin-like assets and added external fee estimator for DOGE. External fee estimation is useful as a fallback for SPV (light) wallets and also RPC (full) wallets that have been started recently when their fee estimation has not calibrated yet.

- Added default values for wallets created over RPC. This is to assist testing on simnet.

- Moved more strings translation files.

- Database compaction tuned to more aggressively free up space and report the savings more accurately.

- Added more detailed progress reporting during login.

- Added Arabic translation and the required tweaks for showing right-to-left text.

- Fixed SPV wallet log file deletion during wallet recovery.

- Fixed fiat value on the Send form not including the transaction fee.

- Fixed handling of the Pre-size Funds option. This option creates an extra “split transaction” to prepare an exact amount of funds needed for the order, which avoids locking more funds than needed, but at the cost of additional fees to pay for the split. The fix avoids the pre-sizing transaction when there is no benefit. Also, the UX is made more consistent by always showing the option but explaining why it was turned off. Finally, another fix disables pre-sizing for immediate market orders since they must execute quickly.

- Other fixes.

Image: First trade between USDC and DCR on testnet.

dcrdata

dcrdata is an explorer for Decred blockchain and off-chain data like Politeia proposals, markets, and more.

User-facing changes:

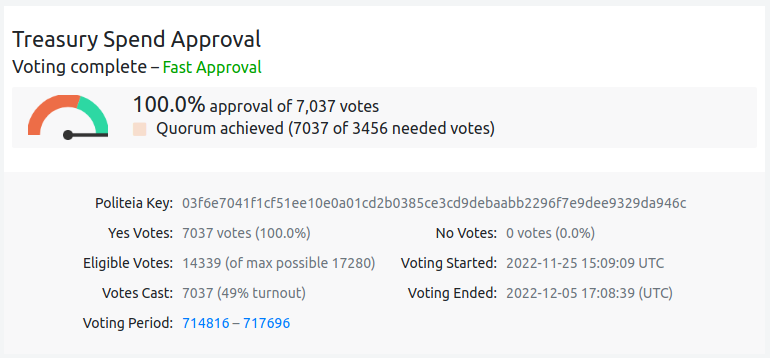

- Treasury voting rules and progress became easier to understand and follow. Treasury spend transaction pages will show how current votes compare to minimum quorum and Yes percentage requirements, approximate calendar dates of start and end of voting, which Politeia key signed the TSpend, and more. An example recent TSpend can be seen here.

- Fixed a rare bug where disapproved transactions that were later included in an approved block had their outputs incorrectly shown as unspent. Less than 20 transactions were affected in the entire chain history.

- Other fixes and UI tweaks.

Developer and API changes:

- Removed some dcrwallet imports to simplify updates to new dcrd modules.

- Removed the requirement to run dcrd with address index enabled because it was removed from dcrd. Usage of dcrd’s

searchrawtransactionsmethod (which depends on the address index) was removed in favor of dcrdata’s own database that has all the necessary information. - Added two fields to the transaction data API:

tree(Decred blocks store transactions in regular and stake trees) andtype(Decred transactions can beregular,ticket,vote,revocation,coinbase,treasurybase,treasury add,treasury spend).

Image: dcrdata, now it is easier to track TSpend voting progress.

Bison Relay

Bison Relay is a new peer-to-peer social media platform with strong protections against censorship, surveillance, and advertising, powered by Decred Lightning Network.

Bison Relay has been revealed after 2 years of initial development by Company 0. End-user details can be found in the announcement above, and here we will focus on the tech and recent changes in the source.

Bison Relay tech stack overview:

- Server is written in Go and uses PostgreSQL for storage.

- Command-line client is written in Go and implements text-based UI similar to Irssi or WeeChat.

- GUI client is a cross-platform app written in Dart, Flutter, and a Go library implementing the Bison Relay protocol. Flutter is a promising platform for building cross-platform GUI apps for major desktop (Linux, macOS, Windows) and mobile (Android, iOS) systems from a single codebase.

- All client to server communications are double encrypted using a TLS tunnel as the outer layer and

NaCl secretboxas the inner layer. - All client to client communications are encrypted with a double ratchet (a third layer of encryption) with keys that only the clients have.

- More details can be found in the docs dir and the protocol overview.

GUI app, changes released in v0.1.1:

- Fixed multiple issues with notifications, layout and number formatting.

- Fixed user getting stuck after an unfinished seed setup and added a choice to delete an unfinished wallet.

- Fixed unreadable font color in server fingerprints.

- Fixed hitting a gap limit when opening LN channels.

- Other fixes.

GUI app, changes in master towards next release:

- Added save/restore of unsent message draft when changing to/from another view.

- Added seed restore page.

- Added a button to copy seed to clipboard.

- Added support for saving and restoring Static Channel Backup (SCB) files. Funds locked in LN channels cannot be recovered from wallet seed alone. Recovery data that cannot be generated from the seed is stored in SCB files.

- Changed window title to “Bison Relay”.

GUI app, improved onboarding:

- Show directions on the empty chats page to add funds, create channels, and connect with other users using invites.

GUI app, fixes:

- Fixed missing autofocus of the input field when switching chats.

- Fixed unreadable text color in multiple places.

CLI app:

- Limit displayed title to 255 characters.

- Right-align comment timestamps.

- Added an option to import an SCB backup when restoring an existing wallet from seed.

- Fixed crash when relaying a post.

bisonrelay.org website is a static site build with Hugo, Bootstrap, and SCSS. Site source code is also public.

Website December changes:

- Release preparations.

- Animated down arrow.

- Added copy for the Features page.

- Added Tutorial page.

Future plans for Bison Relay have been announced on BR itself:

we’re designing the next set of features for br, which include the ability to have some sort of “pages”, for both content and as store front. The current iteration of this feature is that a client can provide “pages” that other key-exchanged clients can view and interact in some way. [@jy-p on 2022-12-18]

People

Welcome the new first-time contributors:

- c12 (Decred Magazine author, @c12hz on Twitter)

Community stats as of Jan 4 (compared to Dec 2):

- Twitter followers: 53,392 (-342)

- Reddit subscribers: 12,648 (+14)

- Matrix #general users: 738 (+9)

- Discord users: 1,530 (-348 - purged inactive users), verified to post: 929 (-7)

- Telegram users: 2,872 (-22)

- YouTube subscribers: 4,640 (+0), views: 221K (+2K)

Our main @decredproject account has been observed having 2 out of 4 bans activated: Ghost Ban and Reply Deboosting, according to Twitter Shadowban Check. Reportedly, not too long ago all 4 were active. This and other reports somewhat explain Twitter performance seen so far.

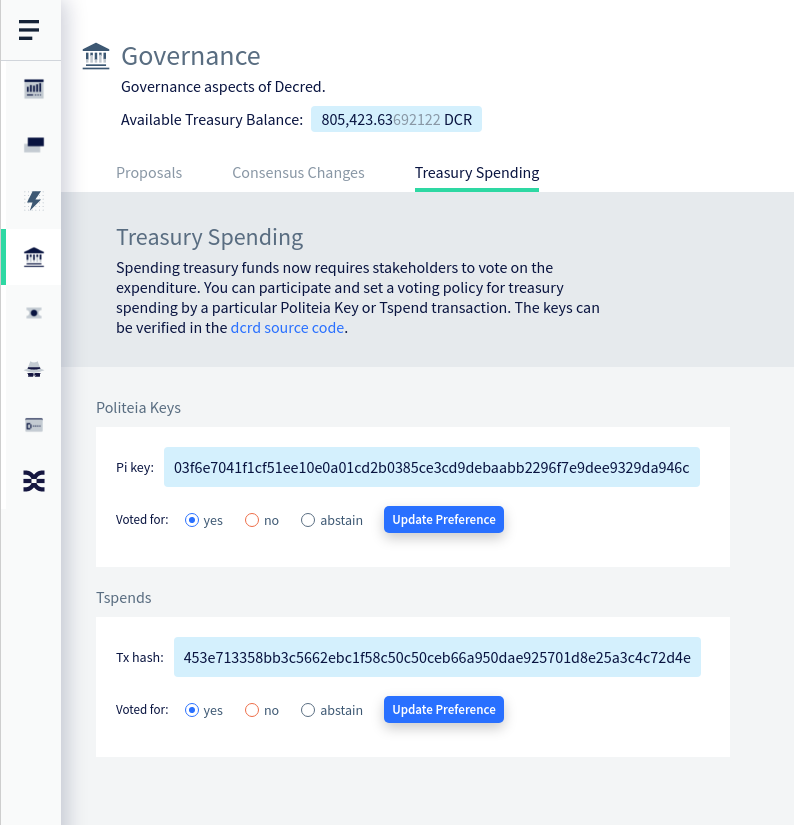

Governance

In December the new treasury received 8,712 DCR worth $172K at December’s average rate of $19.79. 3,907 DCR was spent to pay contractors (but the transaction was not approved/mined until January 3), worth $77K at December’s rate, or $86K at November’s billing rate of $21.92.

The treasury spend tx had 24 outputs making payments to contractors, ranging from 5 DCR to 1,270 DCR.

As of Jan 7, combined balance of legacy and new treasury is 834,055 DCR (15.6 million USD at $18.70).

There were no new proposals published on Politeia in December.

Network

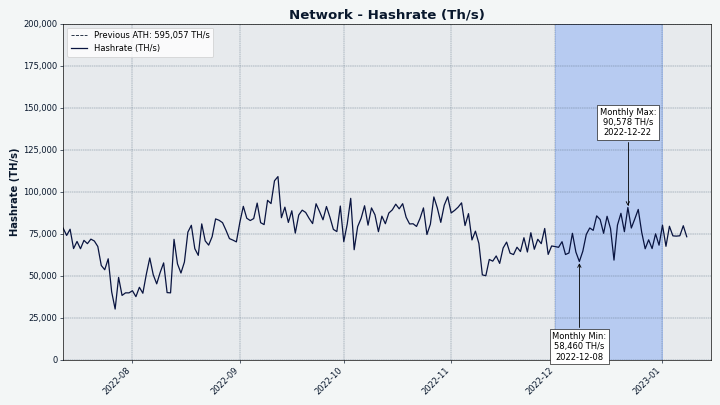

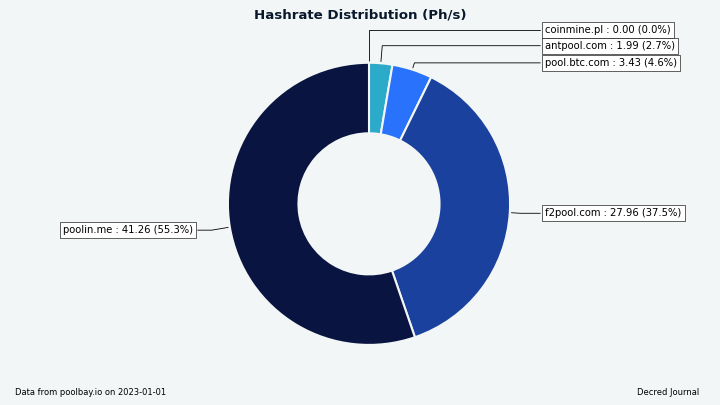

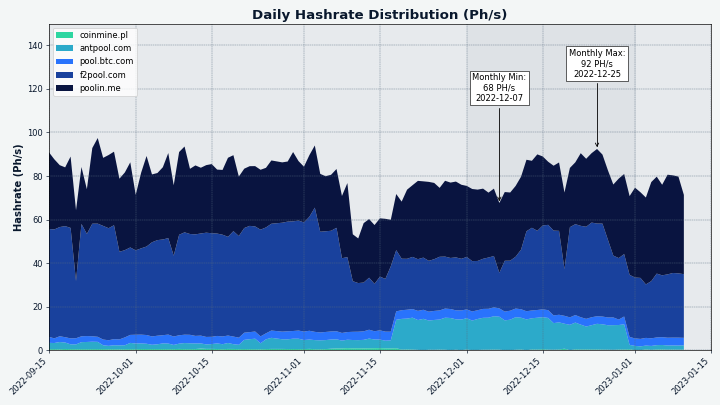

Hashrate: December’s hashrate opened at ~67 Ph/s and closed ~68 Ph/s, bottoming at 58 Ph/s and peaking at 91 Ph/s throughout the month.

Image: Decred hashrate.

Distribution of 75 Ph/s hashrate reported by the pools on Jan 1: Poolin 55%, F2Pool 38%, BTC.com 5%, AntPool 2.7%.

Distribution of 1,000 blocks actually mined by Jan 4: Poolin 55%, F2Pool 36%, likely BTC.com 5%, likely AntPool 2.6%, CoinMine 0.4%, unknown 0.9%.

Image: Pool hashrate distribution.

Image: Historical pool hashrate distribution.

Staking: Ticket price varied between 234-244 DCR, with 30-day average at 234.8 DCR (+3.3).

The locked amount was 9.46-9.62 million DCR (new all-time high), meaning that 64.0-64.8% of the circulating supply participated in Proof of Stake.

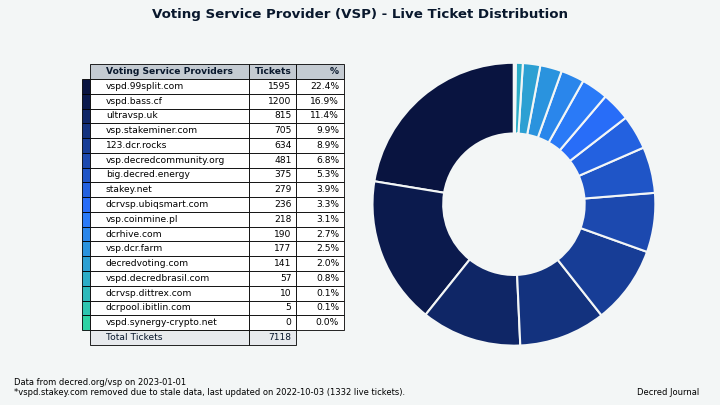

VSP: The 17 listed VSPs collectively managed ~7,120 (+190) live tickets, which was 17.2% of the ticket pool (+0.4%) as of Jan 1. These figures exclude vspd.stakey.com due to stale API data.

Biggest gainers in December are vspd.bass.cf (+371), big.decred.energy (+179) and vspd.99split.com (+178).

Image: Distribution of tickets managed by VSPs.

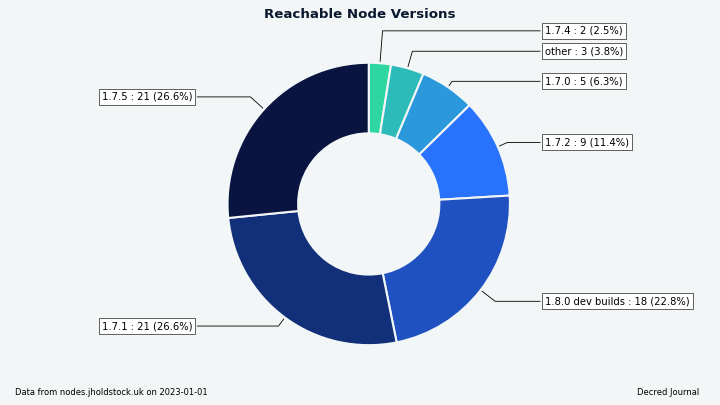

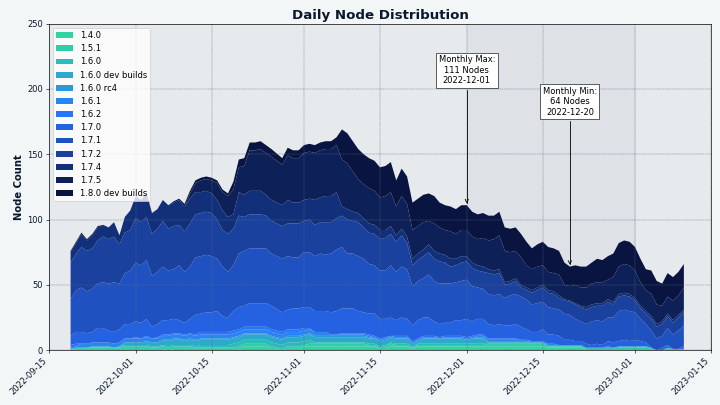

Nodes: Decred Mapper observed 79 dcrd nodes on Jan 1: v1.7.5 - 27%, v1.7.1 - 27%, v1.8.0 dev builds - 23%, v1.7.2 - 11%, v1.7.0 - 6%, v1.7.4 - 2.5%, other - 4%.

Image: Reachable dcrd node versions.

Image: Historical dcrd version distribution, data from nodes.jholdstock.uk.

The share of mixed coins varied between 61.1-61.4%, or 9.02-9.10 million DCR (new all-time high). Daily mixed amount varied between 291-479K DCR.

The launch of Bison Relay had a major impact on Decred LN. Comparing stats from @karamble’s node observed on Dec 1 and Dec 19: nodes 67 -> 120, channels 104 -> 212, capacity 40.6 -> 91.1.

Decred’s Lightning Network explorer is back up and has reported 130 nodes, 233 channels with a total capacity of 100.7 DCR, as of Jan 4. These stats vary depending on the LN node. For example, @karamble’s node reported 144 nodes, 312 channels and 154 DCR capacity on Jan 4.

Ecosystem

The VSP vspd.synergy-crypto.net has been removed from the API after voting its remaining live tickets. It had been serving since June 2021 and voted a total of 892 tickets. The shutdown was executed cleanly: it stopped accepting new tickets in August 2022 and over the next 4 months all live tickets have voted.

Poloniex has re-enabled the DCR/BTC market which was frozen since Sep 30 when the exchange tweeted that the DCR wallet is still on maintenance (since January 2022). The market was first re-enabled on Nov 28 but was quickly frozen again for another week until being fully restored on Dec 5.

Binance was rejecting DCR withdrawals for about 10 days. First reports of rejected withdrawals surfaced around Dec 12. Some went through on Dec 14 but next day more withdrawals got suspended. Binance shared conflicting information about the cause of the outage. Support Twitter called it “standard maintenance procedure”. In one support ticket they cited DCR network being “busy”, but later revealed having insufficient funds in the hot wallet. Wallet Maintenance Updates lists no posts about the issue as of writing. The issue was resolved around Dec 22. The blockchain was working as expected and no outages or issues were seen elsewhere in the network.

Join our #ecosystem chat to follow Decred ecosystem updates.

Warning: the authors of the Decred Journal have no idea about the trustworthiness of any of the services above. Please do your own research before trusting your personal information or assets to any entity.

Outreach

Monde PR’s achievements:

- Pitched 1 news update

- Secured 1 media interview

- Pitched 8 commentary ops

Secured the following news articles:

- An article in CoinJournal featuring commentary from @jy-p on mistakes to avoid when buying cryptocurrencies.

- An article in CoinJournal featuring commentary from @jy-p on tips for those just getting into crypto.

- An article in CoinJournal featuring commentary from @jy-p on how to choose a crypto platform.

- A piece in Cryptonews about the launch of Bison Relay.

- An article in Invezz about the launch of Bison Relay.

- @jy-p was interviewed by the Piece of the Py show, discussing the launch of Bison Relay, Decred’s use in the 2022 Brazil elections and the launch of DCRDEX v0.5.

- An article in BeInCrypto featuring commentary from @jz on focusing on decentralization in 2023, with a DCRDEX mention.

Events

Attended:

- @arij attended a panel discussion called Women Entrepreneurship organized by JCI Casablanca (as part of the 17th edition of the Entrepreneur’s Evening event). She talked about her experience with the IT industry, crypto, how Decred DAO operates and what it is like to work for it. See the report for more details and links.

Media

Selected articles:

- What is wrong with Decred? by @jy-p

- Embracing degeneracy, part 1 – Decred NFTs by @c12hz

- Trapped in the web by @jy-p

- Bison Relay: The sovereign Internet by @jy-p

- The P2P World Wide Web by @phoenixgreen

- Imagining the future of Bison Relay by @c12hz

- What does dcrd do? by @phoenixgreen and @zippycorners

- Decred vs Bitcoin: From start to the end! by @Joao

- Breaking through the facade of social media delusion by @BlockchainJew

- Decred 2022 end of year summary by @phoenixgreen

- A learning from 2022 by @HassanMaishera

Decred Magazine engagement stats as of December:

- Total number of articles on DM: 371

- Newsletter subscribers: 83

- Total newsletters sent: 22

- Active social media campaigns: 25

- Completed social media campaigns: 27

- Social media posts: 214

- Likes: 1,040

- Re-tweets: 169

- Social media followers across all platforms and accounts: 1,090

Videos:

- 2022 the year of the bear - Decred and the State of the Market feat. @phoenixgreen, @Exitus, and @Tivra (podcast audio version)

- Decred and the atomic swap revolution - DCRDEX Fundamentals by @phoenixgreen - also available as an audio podcast and as a text post

- Setting up BisonRelay 0.1.1 on macOS by @phoenixgreen

- Bison Relay - First look (version 0.1.1) By @phoenixgreen

- My chat with Decred founder/CEO Jake by Py Patel in Piece of the Py Show

- Decred News - Bison Relay P2P chat + social media on Lightning is here! Big dev updates! by @Exitus

Audio:

New Twitter Spaces recordings:

- Bison Relay: The sovereign Internet by @Tivra and @kozel feat. multiple community members. 1.7K people tuned in (live + recorded). Also on Anchor and other podcast platforms.

- Exploring possibilities of decentralized social media - by @Tivra and @kozel feat. community members, ~550 people tuned in. (Anchor)

Art and fun:

- Bison Relay launch lightning image by @karamble

- 2023: Decred a crypto odyssey by @OfficialCryptos

Translations:

- Decred Journal September-November got a total of 4 new translations to Chinese (@Dominic) and Polish (@kozel). Thank you for spreading the word!

Non-English content:

- Decred Une Crypto Trop Meconnue 🧐 Pour Combien dE Temps ? 🔥 Par des anciens DEV du Bitcoin 💎 (project overview + TA in French)

Markets

In December DCR was trading between USDT $18.20-$24.80 and BTC 0.00110-0.00145. The average daily rate was $19.79.

The new DCR/USDT market on Poloniex has seen around 1,070 DCR daily average volume, much higher than 230 DCR/day on the old DCR/BTC pair. Interestingly, DCR/BTC market was frozen for the first week while DCR/USDT was active.

Image: DCRDEX monthly volume in USD.

Relevant External

In November, plans to outlaw privacy-enhancing crypto coins in the EU were leaked. The plans were put forward by the Czech officials who are currently chairing talks. Crypto-asset service providers and other institutions would be banned from holding or touching privacy-enhancing cryptocurrency under the proposal.

In Brazil, Congress has passed a bill to regulate crypto payments, it will allow banks to offer services around crypto assets, and also covers things like airline points.

Avraham Eisenberg, the front man who took public credit for the “highly profitable trading strategy” which drained Mango Markets of $110 million, has been arrested and charged with market manipulation offences.

SBF was charged with a number of offences and agreed to be extradited to the US, where he was granted bail on a $250 million bond on the condition that he stay at his parents’ house. The names of some wealthy associates who covered part of the bond have been kept secret, unusually. The trial is scheduled to start in October 2023.

Popular crypto news and research providers The Block were revealed to be secretly bankrolled by SBF through Alameda, it looks like three loans were made to Block CEO McCaffrey, one of which was used buy an apartment in the Bahamas. It appears that none of the Block’s editorial staff were aware of the arrangement between SBF and McCaffrey, who has now resigned.

The Grayscale Bitcoin Trust has been puzzling and spooking some investors, as its “discount to NAV” (price of a share of the trust vs the value of the amount of Bitcoin one share represents) increased to a whopping 45%. In Summer 2022 Grayscale’s application to convert the fund to an ETF was denied, so it is presently stuck in a position where investors cannot claim the BTC their shares entitle them to, although this decision is under appeal. Grayscale is owned by the Digital Currency Group, which also owns troubled crypto lender Genesis, which had to suspend its operations in the wake of FTX’s collapse, and in January cut 30% of its workforce. The Digital Currency Group owns many companies in the crypto space, and there has been some speculation about which of these they might sell to bail out the struggling ones. Their holdings include CoinDesk, which broke the story about FTX which triggered the present difficulties for DCG. The cryptocurrency holdings of DCG have been the subject of some controversy, as Grayscale’s refusal to participate in providing “Proof of Reserves” was one of the factors which caused suspicion initially - although Coinbase has stepped up to vouch for their assets being safely held.

It has been a tough year for Bitcoin miners, and in particular the Northern American industry which grew rapidly fuelled by cheap credit in 2021 and lured in by the gap left when China banned PoW mining. As the price of BTC declined by 63% in 2022 the industry was becoming more competitive, leading to a 70% drop in mining profitability. As the problems became clear the value of top mining machines declined 85% and the value of shares for the mining companies fell from between 80-98%. In December Core Scientific, one of the largest US crypto miners, has filed for bankruptcy.

The US Federal Reserve is gearing up to unleash “FedNow” in May-July 2023, a version of the digital dollar for depository institutions which their clients will be able to access and use directly for instant processing and settlement 24/7 hours a day 365 days a year. This is distinct from any retail-facing CBDC, which is so far not being actively planned in the US but some experiments have taken place.

The Bank of England actively seeking applications from companies to build a prototype mobile wallet app, merchant website and back-end server for the core ledger - and offering a budget of £200,000 for the winning entry.

ConsenSys faced a backlash over an update to its privacy policy in November, with users objecting to the collection of IP address information through RPC provider Infura and linking this to addresses and account balances. A response from ConsenSys in December clarified that they only collect data for “write” events (like making a transaction) and not when the user merely checks their balances, and that they have been doing this since 2018. They pledged to no longer store the IP data alongside the account access data, and to make it easier for users to change RPC provider through the interface.

Sia launched a community grants program in September, and provided an update in November. There is a small panel which reviews proposals and so far they have approved two proposals - Lume Web aims to “use Skynet to enable Sia to act as the internet”, is getting $80K, and Sia Satellite, which will allow people to pay to use Sia storage with a credit card, $26K. In December another update reported that Fabstir’s proposal had been approved for $40K, and plans to collaborate with Lume Web on other aspects of the “web3 platform”, like social media for the creator economy with sales and tipping. The other two proposals have been rejected, but with an option to edit and re-submit.

The Osmosis DAO (Osmosis is a major DeFi platform on Cosmos) looked back on 2022. There were 278 proposals, of which 26 were rejected, so 90% of proposals passed. One of the highlights appears to have been “superfluid staking” (otherwise known as “reverse liquid staking)”, which allows liquidity providers to bond the tokens they get such that the underlying OSMO can be staked to contribute to securing the blockchain. Initially voting rights were delegated along with stake to the staker’s choice of validator, but a successful governance proposal subsequently allowed LP stakers to override the votes of their chosen validator. Osmosis voters also approved a community grants proposal with a budget of 1.5M OSMO for 6 months and the entity running the program receiving $70K/month on top of an initial $100K - the program was renewed in November.

The Balancer DAO community agreed to a peace treaty with the veBAL (Balancer’s governance token) whale who came to be known as Humpy. Humpy is the largest BAL holder and liquidity provider, and used their voting power to dominate Balancer’s governance and increase the yield rates for the liquidity pools they were personally using. Balancer developers and the community mobilised to mitigate Humpy’s self-dealing but Humpy was still able to extract significant profit by pointing BAL rewards to pools they created with high fee levels. The peace treaty was approved almost unanimously by the veBAL community in a token vote, Humpy agreed to not increase their BAL position any further and to unwind much of it, with assistance from community members to organise OTC trades.

DFINITY Foundation announced the launch of a Bitcoin integration with the Internet Computer (IC), with IC serving as a layer 2 for Bitcoin without a centralised bridge.

Donald Trump launched his own NFT collection, selling 45,000 “trading card” images showing him dressed in various costumes for $99 each. The NFTs were all minted within 24 hours and it was a popular NFT collection to trade initially, the floor price on the secondary increased to over $200. The NFTs would entitle holders to access certain Trump-related activities, and these passes are in Jan being airdropped to holders, but are not proving as lucrative to trade, with tokenized tickets to access group Zoom calls with the Donald changing hands for less than $25 a piece.

That’s all for December. Share your updates for the next issue in our #journal chat room.

About

This is issue 54 of Decred Journal. Index of all issues, mirrors, and translations is available here.

Most information from third parties is relayed directly from the source after a minimal sanity check. The authors of the Decred Journal cannot verify all claims. Please beware of scams and do your own research.

Credits (alphabetical order):

- writing, editing, publishing: bee, bochinchero, Exitus, jz, l1ndseymm, phoenixgreen, richardred

- reviews and feedback: davecgh, jholdstock, JoeGruff

- title image: saender

- funding: Decred stakeholders