Decred Journal – March 2023

Image: Untitled by @Exitus

Highlights of March:

-

A proposal was made and approved to change the block subsidy payout from 10/80 PoW/PoS to 1/89, as well as change the algorithm to exclude specialised hardware.

-

Bison Relay v0.1.5 was released and v0.1.6 RC1 is already out as well.

-

DCRDEX 0.6 is being beta tested and release candidates are appearing.

-

Decred Journal was one of four proposals to be approved for the month, with three for specific aspects of DCRDEX development.

Contents:

- Proposal to change PoW algorithm and reduce PoW rewards

- Bison Relay v0.1.6 Release Candidate

- Development

- People

- Governance

- Network

- Ecosystem

- Outreach

- Events

- Media

- Markets

- Relevant External

Proposal to change PoW algorithm and reduce PoW rewards

A major change is coming to Decred’s consensus and economics. A proposal has been submitted to further reduce the Proof of Work share of rewards from 10% to 1%, increase Proof of Stake rewards from 80% to 89%, and change the mining algorithm from BLAKE-256 to BLAKE3. This will remove all currently mining ASIC hardware from the network with the goal to fix the price discovery of DCR. As of writing the proposal has been approved. Next steps will be to implement new consensus rules in code, release a new version of core software, let the network install it and let the stakeholders vote to activate the new rules. All of it should take a few months and there will be more communication about each stage on Decred’s official channels.

Bison Relay v0.1.6 Release Candidate

Two releases came out in March focused on improving group chat experience.

Highlights of v0.1.5 release:

- New Payment Stats page

- QR codes for deposit addresses

- Improved error messages

- Fixed group chat member list getting out of sync

- Fixed group chat message ordering

- Other bug fixes and UI tweaks

Highlights of v0.1.6 Release Candidate 1:

- New version of group chats with support for multiple admins

- Sidebar notifications for new messages

- Automatic group chat invites bundled in invite files

- Highlighting of messages with user’s nick name

- More visible New Post button

- All post comments are directed to the original post, comments on relayed copies are disabled

- Many bug fixes and UI improvements in both GUI and CLI apps

Get the latest release binaries on GitHub (as of writing the Downloads page at bisonrelay.org still shows v0.1.4). Bug reports and feedback are welcome in the GitHub issue tracker and the #br chat on Matrix or Bison Relay itself.

Development

The work reported below has the “merged to master” status unless noted otherwise. It means that the work is completed, reviewed, and integrated into the source code that advanced users can build and run, but is not yet available in release binaries for regular users.

dcrd

dcrd is a full node implementation that powers Decred’s peer-to-peer network around the world.

Hardening of consensus change voting code continued from last month:

- Enhanced startup validation of deployment parameters to ensure they satisfy the assumptions that the vote tallying logic relies on. For example, it checks that each vote has exactly one Abstain and one No choice, that there are no duplicate vote choices, and that choices are properly encoded in bits. This allows to optimize and simplify code related to vote tallying.

- Added validation to ensure consensus change vote parameters don’t use special bits reserved for approving or disapproving the previous block.

- Added validation to ensure that bits used by different votes in the same voting batch do not overlap.

- Added validation rejecting vote choices with empty IDs. IDs are short strings summarizing what the vote choice means, they are normally

"yes","no"or"abstain". - Reworked code determining consensus vote stage and vote tallying logic to optimize it and make it easier to reason about.

- Changed internal representation of the winning consensus vote choice for improved readability and additional protections from misusing this code.

- Reworked tests for consensus vote processing code to make them easier to understand, test more edge cases, and do so more reliably.

- Note that the above changes are not breaking the consensus between versions in any way, they add more checks that allow dcrd to fail earlier if it detects that any assumptions made by the consensus code are violated.

Other changes:

- Re-request blocks and transactions sooner if the peer which was queried for them disconnects. Instead of waiting for this data to be announced again later, it will be requested immediately from peers that are known to have it.

- Fixed caching of other peers’ known inventory. It was a very minor bug with the potential to cause slightly higher traffic than is strictly necessary.

- Refactoring and build config updates.

dcrwallet

dcrwallet is a wallet server used by command-line and graphical wallet apps.

- Removed needless balance calculation when using the ticket auto buyer with balance to maintain unset or zero. On busier wallets this results in a significant performance improvement.

- Migrated to VSP client provided by the vspd repository. It is mostly the same code borrowed from dcrwallet, but consolidating VSP code in one place allows for removal of duplication that may fall out of sync, such as error codes, data structures, etc.

- Fixed data race in SPV mode.

- Fixed possibility of missing relevant transactions in case the ticket purchase request is cancelled due to a change of the ticket price.

Decrediton

Decrediton is a full-featured desktop wallet app with integrated voting, StakeShuffle mixing, Lightning Network, DEX trading, and more. It runs with or without a full blockchain (SPV mode).

In progress:

- Decrediton Ledger integration effort has been kickstarted by @JoeGruff with an initial proof of concept and a follow-up proposal to make it production ready. Currently users are required to use Ledger Live software to send/receive DCR from/to their Ledger device, but historically there have been too many technical problems with that software. Having Ledger support directly in Decrediton will give DCR holders a better choice.

Other:

- Staking DCR with Decrediton+Trezor is again blocked by changes required in firmware. A fix has been submitted to the Trezor firmware repository in December but has not been reviewed or merged yet.

vspd

vspd is server software used by Voting Service Providers. A VSP votes on behalf of its users 24/7 and cannot steal funds.

Changes to make vspd code easier to consume by other software (such as dcrwallet):

- Removed ability to override server signature validation with a custom function. This feature was added to facilitate testing but turned out to be unnecessary and make the VSP client library harder to consume.

- Removed the need to convert errors in the calling code. This was required to bump the major version of the module to v2.

Other changes:

- Added rate limiting of admin login requests (max 3 attempts per second) and a sample Nginx config to support it.

- Added new development tool for testing various steps of the VSP protocol: create VSP fee transaction, send it to the VSP, query ticket status, and change ticket’s vote choices. VSP operators can use this tool to verify that their VSP works correctly.

- Increased test coverage.

Lightning Network

dcrlnd is Decred’s Lightning Network node software. LN enables instant and low-cost transactions.

- Upgraded to build and test against Go 1.20.

- Updated dependencies.

LN Liquidity Provider (LP):

- Added client-side sanity checks to fail earlier when it is not possible to get an inbound channel from the LP. The client will use server’s policy to determine if the server can create a channel of the desired size, and if the client will be able to pay for it. This makes it possible to avoid fetching an invoice that will not be paid.

- Capacity to configure LP server’s invoice expiration policy. Invoices are generated by the server to collect fees for opening LN channels to clients. Server operator can now configure how long invoices are valid for, and how long clients must wait before requesting a new invoice.

- Updated dependencies.

LN Liquidity Provider is software that takes control of a normal LN node and adds one useful feature to it: client software can ask the LP to open a channel back to the client. This gives the client additional inbound capacity and allows them to receive more funds over the Lightning Network. In return the LP operator collects a small fee for the service.

Bison Relay is a major user of Decred’s Lightning Network and benefits from improvements in both the base LN software and the Liquidity Provider.

cspp

cspp is a server for coordinating coin mixes using the CoinShuffle++ protocol. It is non-custodial, i.e. never holds any funds. CSPP is part of StakeShuffle, Decreds privacy system.

- Updated Go dependencies.

DCRDEX

DCRDEX is a non-custodial, privacy-respecting exchange for trustless trading, powered by atomic swaps.

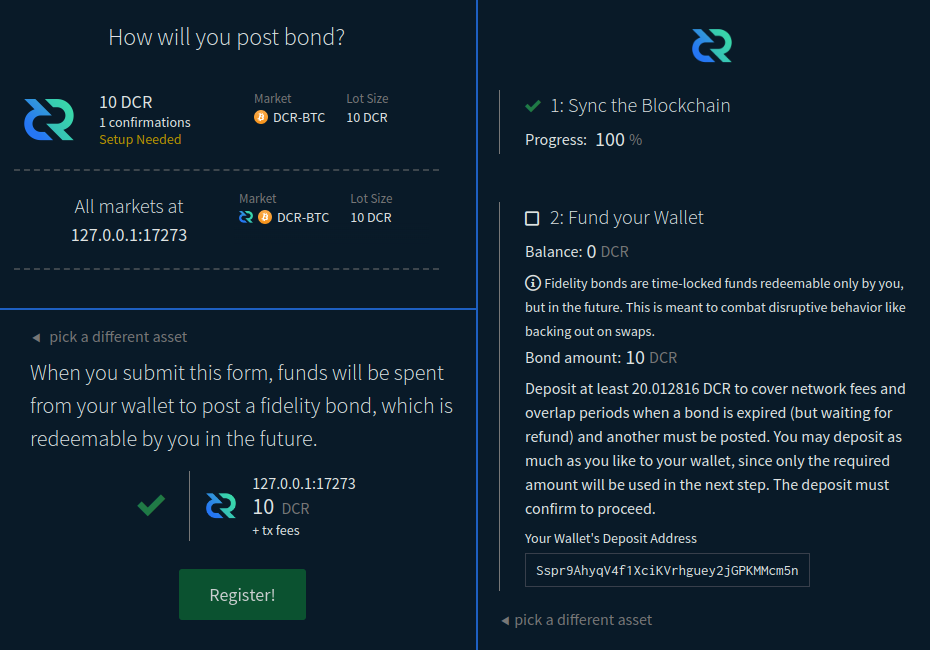

Internal pre-release testing of the big v0.6 release has started with one beta and two release candidates tagged in March. All changes reported below will be included in the v0.6 release.

Client changes:

- Removed default Bitcoin node for getting compact block filters in SPV mode. It was added when there were few public Bitcoin full nodes supporting BIP-157. Now there are plenty and removing the default one may improve connectivity because it is often overloaded.

- Improved error message when database failed to initialize, most commonly when attempting to start a second instance of dexc.

Client fixes:

- Fixed empty gaps between candles on the price chart.

- Fixed inconsistent decimal precision on different UI elements.

- Fixed price not being updated in some places.

- Fixed reorg indication for DCR and BTC in SPV mode to match dcrd and dcrwallet. Specifically, blocks that are not on the main chain (“orphaned” blocks) will be reported as having “-1” confirmations.

- Fixed wallet birthday showing UTC date instead of system’s local date.

- Fixed ~5 other UI bugs and ~1 concurrency bugs.

Ethereum, client:

- Improved handling of poor connections to RPC providers while the DEX client is shutting down.

- Added Ethereum wallet guide wiki page.

- Added a 20% buffer to the fee estimates ensure sending ETH will succeed even if network’s base fee jumps right before sending.

- Updated to Geth v1.11. This is required for the Shanghai network upgrade scheduled on April 12, 2023.

- Fixed token’s parent asset balance not being updated when cancelling an order involving that token.

- Fixed unconfirmed transactions not being reflected in the available balance.

- Fixed error messages.

Ethereum, server:

- Allow server operators to rank RPC provider endpoints by priority in the config file. The healthy connection with the highest priority will always be attempted first.

Fidelity bonds:

- UI updates to replace registration fees with bonds, including integration of bonds into account import and export flows. Different cases are considered when restoring from same or new app seed, and when using existing or creating new DEX account.

- Implemented bonds funding with BTC in both the client and the server. It will be possible to switch bonds to use a different asset, e.g. from DCR to BTC.

Other changes:

- Added more strict server-side checks for addresses used in swaps.

- Updated LTC dependencies to pull in a critical fix for handling large transactions.

- Improvements in test infrastructure, build scripts, dependency updates.

Client changes on master towards the next release (likely v0.6.1):

- Notify the user about unstable connection.

- Fixed error when failing to subscribe to new header notifications from Ethereum RPC provider.

Other stuff:

- DCRDEX was rejected in the official Umbrel App Store because “for crypto-related apps, we’re exclusively accepting apps that solely focus on bitcoin”. Two weeks later they tweeted that censoring developers is anti-free market, which surprised some community members in context of the rejection. DCRDEX can still be installed via Umbrel by adding DEX’es own Community App Store. The difference is it requires more manual steps and exposes DCRDEX to fewer users compared to the central official Umbrel App Store.

- First mainnet swaps with DigiByte (DGB) have been spotted on Twitter.

Image: UI updates in DCRDEX to replace registration fees with time-locked bonds. UI design is a work in progress. DCR amounts shown are not real.

dcrdata

dcrdata is an explorer for Decred blockchain and off-chain data like Politeia proposals, markets, and more.

- Added an allowed hosts middleware to ensure that any

Hostvalue set in the request header is on a whitelist of hosts. This prevents invalid or unexpectedHostvalues even if dcrdata is deployed without Nginx, which normally takes care of it. - Updated Decred and third party Node.js modules and Go dependencies to their latest versions, and moved builds to Go 1.19 and 1.20.

Documentation

dcrdocs is the source code for Decred user documentation.

- Added syntax highlighting to fix issues with hard to read code syntax, particularly in dark mode.

- Updated PoS reward numbers (30% to 80%) in the proof-of-stake Overview page.

- Added a glossary entry for “Redeem Script”.

- Updated VSP staking information on multiple pages. This includes removing most references to Redeem Scripts, removing “legacy” staking instructions, and simplifying the remaining staking instructions.

- Consolidated the pros and cons of using VSP and solo staking.

- Added a note to the Redeem Script page indicating they are no longer relevant.

- The Buying Tickets With dcrwallet page has been optimized. It now clearly separates Purchasing and Voting tickets in two steps and removes any references to the outdated dcrstakepool system.

- Optimized Docker build: switched to much smaller image based on Alpine Linux, fixed MIME type for RSS feeds, and updated scripts to fail on error.

Dev Docs

dcrdevdocs is the source code for Decred developer documentation.

- Upgraded to MkDocs Material 9 with improved search. Also upgraded to Python 3.11, Nginx 1.22, and optimized the Docker build.

decred.org

dcrweb is the source code for the decred.org website.

Changes to the News page:

- A more readable news outlet name is now displayed instead of website’s domain name.

- Outlet and author are no longer displayed for software releases.

Bison Relay

Bison Relay is a new social media platform with strong protections against censorship, surveillance, and advertising, powered by Decred Lightning Network.

End user binaries have been released for Bison Relay v0.1.5 with all changes and fixes we reported in the February issue. Just one week later v0.1.6 Release Candidate 1 became available for download. Below are all changes in v0.1.6 RC1 and v0.1.6 final. The latter added very minor fixes and no binaries have been made for it.

Common changes in GUI and CLI apps in v0.1.6:

- Implemented new version of group chats that introduces support for multiple admins. Admins can invite or remove members, and assign or revoke admin privileges. The permission to kill the group chat is still only possible by the special Owner role. Existing group chats will have an option to upgrade to new version.

- Improved error handling and logging of failed payments (such as tipping).

- Improved help text for adding LN receive capacity.

- Disallow comments on relayed posts. Commenting on posts will require a key exchange with the original author. Also, once the original post is received from the author, all relayed copies will be removed in favor of the original.

- Fixed bug preventing to accept multiple group chat invites at the same time.

- Dependency updates and internal refactoring.

GUI app changes in v0.1.6:

- Added sidebar notification icon for new chat messages.

- Show unread count as “1k+” when it is over 1,000.

- Avoid redundant last read indicator when there are no previous messages in the chat.

- Added a prominent New Post button that is easy to access from different views.

- Added highlighting of messages that include user’s nick.

- Added seed verification step where user is required to answer questions about their seed.

- Added About page with app version and copyright info.

- Fixed segfault error on close.

- Fixed errors when leaving or killing group chats.

- Smaller UI tweaks and fixes.

CLI app changes in v0.1.6:

- Added autocompletion of user names and group chat names to various commands.

- Added Alt+V as a Paste hotkey.

- Added a command to decode and inspect LN invoices, improved logging of LN events (such as channel opened or closed).

- Display invite to group chat in a private chat with the inviting user.

- Added an option to include a group chat invite in an invite file. Invite recipient will be invited to group chat automatically after completing the initial key exchange with invite author.

- Fixed wrapping of multi-line text.

clientrpc automation API changes in v0.1.6:

- Improved cancellation and shutdown handling of the read loop.

- Added methods for managing group chats and sending files.

- Fixed reading from the message replay log file.

Other stuff and what to expect:

- Image attachments are now delivered between Bison Relay and Matrix in both directions.

- Prepaid invites have been announced, they will help to onboard new users without requiring them to obtain DCR externally and fund their Bison Relay wallet.

- Next important milestone is prepaid group chat invites, which combine prepaid invites and bundled group chat invites.

- The tech behind Bison Relay GUI (Flutter) provides infrastructure to build mobile apps from the same codebase. Effort is still required to adjust the UI/UX to fit the mobile platform and fix the edge cases specific to mobile, but it’s much easier compared to building mobile apps from scratch in native Android and iOS stacks.

- In the medium term developers plan to add pages and storefronts which will take quite some work to implement.

Other

- Decred Bug Bounty website: added email templates, optimized Docker builds, and added Tanvir0x1 to Hall of Fame.

- Multiple websites updated to use latest Hugo site generator.

People

Community stats as of Apr 3 (compared to Mar 1):

- Twitter followers: 53,189 (+125)

- Reddit subscribers: 12,678 (+18)

- Matrix #general users: 761 (+11)

- Discord users: 1,556 (-1), verified to post: 923 (-9)

- Telegram users: 2,619 (-137)

- YouTube subscribers: 4,630 (+0), views: 226.5K (+1.9K)

Governance

In March the new treasury received 8,388 DCR worth $174K at March’s average rate of $20.69. 4,271 DCR was spent to pay contractors, worth $88K at March’s rate.

A treasury spend tx was mined on March 13, it had 27 outputs making payments to contractors, ranging from 2.7 DCR to 1,264 DCR. At January’s billing rate of $22.05 the TSpend is equivalent to $94K.

As of Apr 13, combined balance of legacy and new treasury is 852,332 DCR (17.8 million USD at $20.90).

There were 7 proposals submitted in March:

-

The Decred Journal and Politeia Digest proposal requested a budget of $40,000 and was approved with 86% Yes votes and turnout of 46%.

-

There were 3 proposals from the Decred DEX team which were all approved. The main proposal for client development asked for a budget of $182,000 and was approved with 94% Yes votes and 49% turnout. A proposal to fund work on packaging the DEX software as a desktop app was funded with a budget of $29,000, 91% approval from 43% turnout. A proposal to fund development of a market maker and arbitrage bot was funded with a budget of $73,000, gaining 89% approval from the 42% of tickets that voted.

-

A proposal from Cointelegraph for $50,000 worth of content was rejected with 41% Yes votes from turnout of 51%.

-

A proposal from @jy-p to change the PoW/PoS subsidy split to 1/89 and also change the PoW algorithm to BLAKE3, removing ASIC hardware designed to mine DCR from the network.

-

A proposal from @joegruff to develop Decrediton support for Ledger hardware at a cost of $20,500.

See Politeia Digest issue 57 and issue 58 for more details on the month’s proposals.

Politeia Digest is available on: Block Commons, Decred Magazine, Medium, and GitHub.

Network

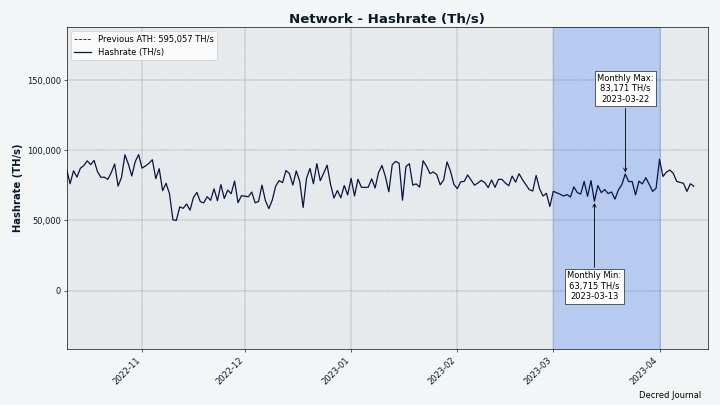

Hashrate: March’s hashrate opened at ~71 Ph/s and closed ~73 Ph/s, bottoming at 64 Ph/s and peaking at 83 Ph/s throughout the month.

Image: Decred hashrate.

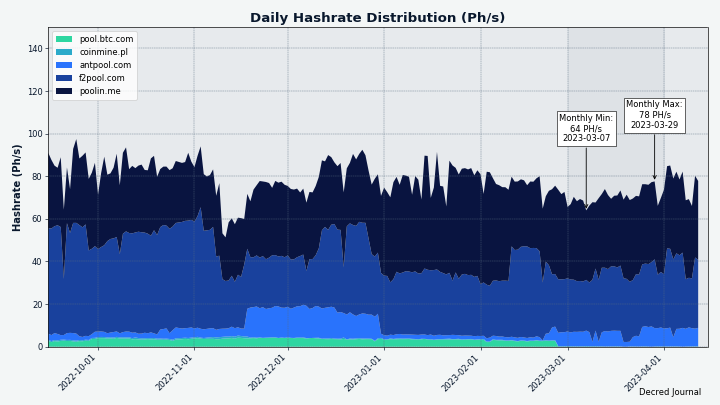

Distribution of 74 Ph/s hashrate reported by the pools on Apr 1: Poolin 54%, F2Pool 35%, AntPool 11%, CoinMine 0.2%.

Distribution of 1,000 blocks actually mined by Apr 3: Poolin 44%, F2Pool 43%, AntPool 9%, BTC.com 3%.

Image: Historical pool hashrate distribution.

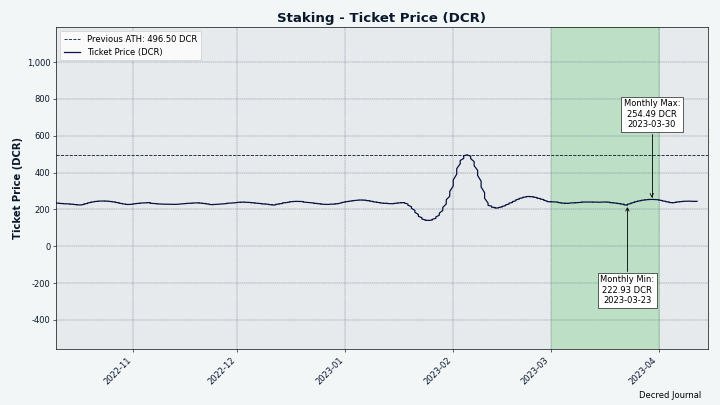

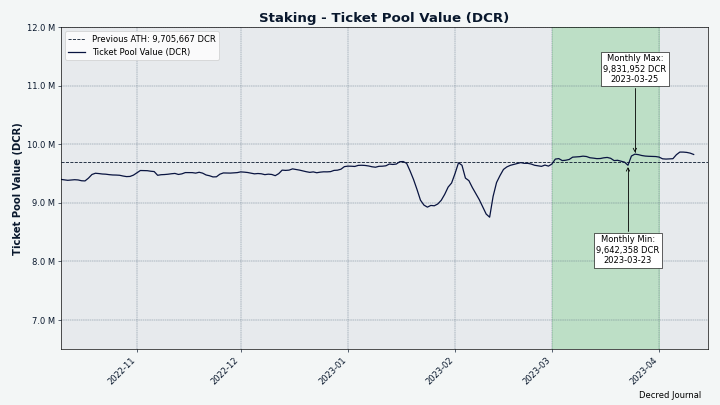

Staking: Ticket price varied between 223-254 DCR.

Image: Ticket price has stabilized.

The locked amount was 9.64-9.83 million DCR, meaning that 64.0-65.2% of the circulating supply participated in Proof of Stake.

Image: DCR locked in tickets keeps crawling up.

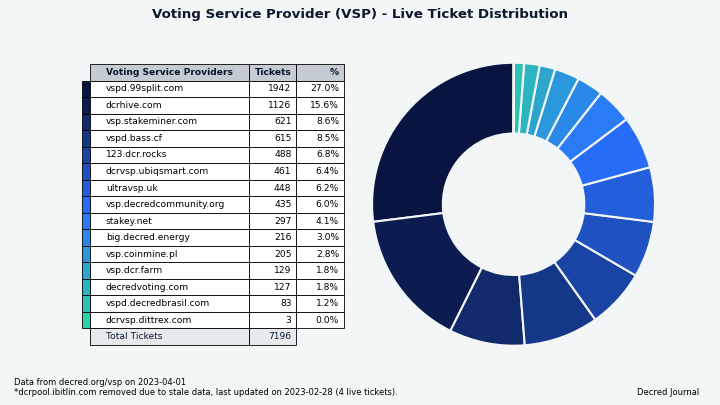

VSP: The 16 listed VSPs collectively managed ~7,200 (-210) live tickets, which was 17.6% of the ticket pool (-0.8%) as of Apr 1.

Biggest gainers in March were ubiqsmart.com (280 tickets or +155%) and dcrhive.com (+225 tickets or +25%).

Image: Distribution of tickets managed by VSPs.

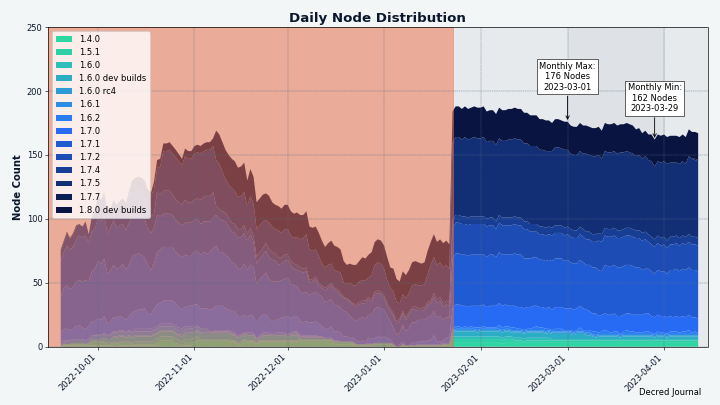

Nodes: Decred Mapper observed between 162 and 176 dcrd nodes throughout the month. Versions of 166 nodes seen on Apr 1: v1.7.5 - 36%, v1.7.1 - 21%, v1.8.0 dev builds - 13%, v1.7.2 - 13%, v1.7.0 - 8%, v1.7.4 - 4%, other - 7%.

Image: Historical dcrd version distribution, data from nodes.jholdstock.uk. Data until Jan 2023 was incomplete.

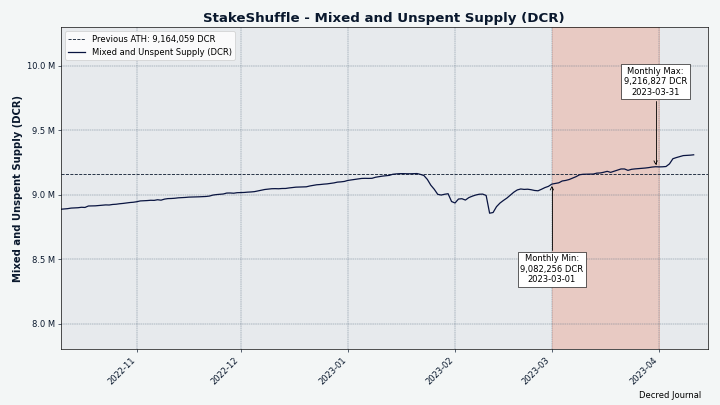

The share of mixed coins varied between 60.5-61.1%. Daily mixed volume varied between 317-495K DCR.

Image: Mixed supply has recovered from a brief drop.

Decred’s Lightning Network explorer has seen 175 nodes (+17), 354 channels (+49) with a total capacity of 129 DCR (+14), as of Apr 3. These stats vary depending on the LN node. For example, @karamble’s node reported 175 nodes (+0), 376 channels (-9) and 135 DCR (-33) capacity on same day Apr 3.

Ecosystem

Metal Pay has disabled DCR trading according to a user report. This is confirmed by their support site which no longer shows DCR in the list of assets available for trading. Assets supporting deposits and withdrawals do not include DCR either, and apparently never did. Other coins delisted in the same batch with DCR include BNB, BUSD, DGB, PAX and TUSD. In the bigger picture, Metal Pay delisted 13 assets in December including XMR, ZEC, DASH and BSV. Since November 2022 the list of tradeable assets reduced from 63 to just 15. Metal Pay first listed DCR in April 2020.

Bittrex’s Instant Buy feature did not work for DCR due to low liquidity, according to a user report. This did not affect limit orders on the full trading interface.

Ledger representative came to Decred’s Matrix chat room to share a status update. The summary is: Decred support in Ledger Live is broken for some users, it is taking a long time to fix, and Ledger would love to redirect affected users to third party services compatible with their devices in the situation where an integration is broken on Ledger’s side. Therefore Ledger will benefit from the upcoming direct integration in Decrediton.

Binance announced the delisting of DCR/BTC and DCR/USDT pairs from Isolated Margin. For context, NEBL and XVG were also part of this delisting batch. Regular (Spot) DCR trading is NOT affected by this. At the same time, personal quota in the Simple Earn product has increased from 300 to 10,000 DCR per person. As of Mar 27, Simple Earn showed 1.67% APR while staking DCR directly yields about 7%/year.

Bittrex made a big announcement about shutting down U.S. operations due to regulatory and economic challenges. Per their timeline, fiat withdrawals must conclude by Apr 24 and crypto withdrawals by Apr 29 (sooner is better). Bittrex Global is not (directly) affected and will continue operations for non-U.S. customers. The move came after Bittrex was fined in December for $29 million for violating sanctions and AML regulations. Despite closing U.S. operations Bittrex may be hit by another lawsuit from the SEC for operating an unregistered securities exchange.

Join our #ecosystem chat to follow Decred ecosystem updates.

Warning: the authors of the Decred Journal have no idea about the trustworthiness of any of the services above. Please do your own research before trusting your personal information or assets to any entity.

Outreach

Monde PR’s achievements:

- Pitched 2 commentary opportunities

- Pitched 8 media opportunities

Secured the following media placements:

- An article in Cointelegraph featuring commentary from @jz on Trezor crypto wallet’s move into the semiconductor business. The article was syndicated to 14 publications including Ethereum Today and Bitcoin Insider.

- An article in CoinDesk featuring commentary from @jz on the long term effects of the U.S. banking crisis on crypto. The article was syndicated to 3 publications including Yahoo! Finance and Markets Insider.

Events

Attended:

- @arij gave a presentation at Technopark Casablanca on the theme “Blockchain and Entrepreneurship”. It started with an intro to blockchain tech use cases and history, followed by a demo of Decrediton and Politeia. The attendees were of different backgrounds including finance, energy and IT sectors. The majority came in response to a LinkedIn announcement.

- Second event by the Decred Arabia team was co-organized by the sports association of Aïn Chock and the District Council of Aïn Chock Casablanca. @khalidesi presented an introduction to blockchains on day 1 and application of blockchains and the Decred example on day 2. The theme was to demonstrate how the blockchain can improve the way businesses operate and promote greater economic and social inclusion.

Upcoming:

- @elian will present the latest updates from Decred in Monerotopia in Mexico City on May 5, 6, and 7. Decred will have a small booth.

Media

Selected articles:

- Decred vs DigiByte: Speed race! by @Joao

- Why is Decred not EVM compatible? by @BlockchainJew

Decred Magazine engagement stats for March:

- Total number of articles on DM: 427

- Newsletter subscribers: 93

- New DM posts and newsletters sent: 18

- Active social media campaigns: 35

- Completed social media campaigns: 35

- Social media posts: 127

- Likes: 709

- Re-tweets: 181

- Social media followers across all Twitter and Facebook platforms and accounts (including @DecredSociety): 1,290

Videos:

- Accounts in Decrediton - Money Evolved by @phoenixgreen

- Timestamply - redesign for timestamping digital existence by @phoenixgreen - also as a text post and as a Spotify podcast

- DCRDEX 0.6 is coming - multi-chain wallets, market maker bots, DigiByte support & more by @phoenixgreen - also as a text post and as a podcast

- Timestamply tutorial demonstration - Decred time stamping by @phoenixgreen - also as a text post

Livestream:

- State of the Market - Content and development proposals for Decred feat. Cointelegraph by @phoenixgreen and @Exitus joined by Matthew and Yana - also as a podcast

Audio:

- Living on Crypto - Rediscovering the original purpose of crypto as cash - @Tivra talks to @TheDesertLynx who has been living on crypto since 2016. “If you’re tired of trad banking and wanna break free, this is for you”. Mirrored on Spotify.

Art and fun:

- Bison Relay rewards animation by @karamble

- Do you even timestamp your existence? animation by @karamble

- Decred DEX - There’s a better way by @buck54321

- The future will not be centralised by @OfficialCryptos

- Decred Pepe crushing miners by @karamble

- What the heck did you just say about Decred? by Laboratory for Memetic Experimentation

- TikTok on Cointelegraph proposal by @DajanaDcr and @Exitus

Translations:

- Decred Journal January-February got a total of 3 new translations to Arabic (@arij, @abdulrahman4), Chinese (@Dominic) and Polish (@kozel). Thank you friends!

Discussions:

- Effects of the current banking crisis on the crypto markets and related issues. Follow @BisonDigest for best convos spotted on Bison Relay, or better, join Bison Relay to not miss any.

- Survey of good marketing ideas

Other:

- @decredmagazine made 3 new TikTok videos

Markets

In March DCR was trading between USDT 17.53-25.90 and BTC 0.00068-0.00102. The average daily rate was $20.69.

Image: Applesaucesome is bullish. Follow on Twitter for more.

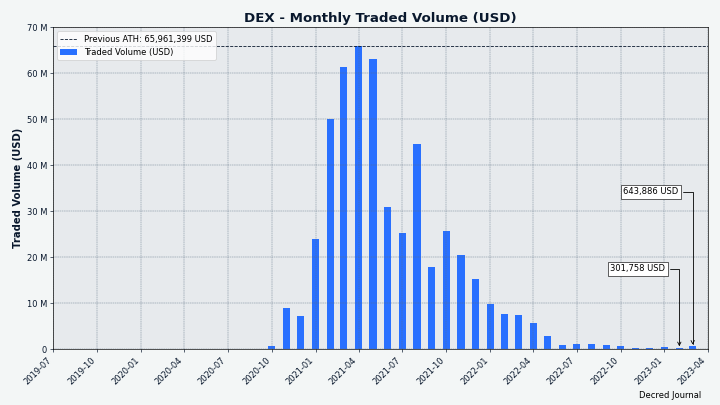

Image: DCRDEX monthly volume in USD.

Relevant External

Three US banks failed in March, the largest of them being Silicon Valley Bank (SVB), which was the second largest US bank failure of all time. One of the ripple effects was a temporary de-pegging of the USDC stablecoin as news emerged that ~10% of the funds backing USDC were stuck with SVB when the FDIC stepped in to take over before Circle’s withdrawal was processed.

The operators of the Tether stablecoin allegedly used falsified documents and shell companies to get bank accounts, in an article by the Wall Street Journal (non-paywalled link). WSJ reviewed a cache of emails from Tether staff which indicated a long-running effort to retain banking access by engaging in various schemes, including having someone in China making fake invoices and contracts to disguise deposits and withdrawals - a policy which was ultimately stopped when owner Stephen Moore wrote he “… would not want to argue any of the above in a potential fraud/money laundering case”.

Nic Carter has documented evidence for what he terms Operation Choke Point 2.0, a deliberate effort to restrict banking access to crypto firms by discouraging banks from dealing with them using various means.

Binance has been charged by the CFTC in a wide ranging complaint which covers a number of offences, including weak KYC/AML that allowed US customers to trade derivatives and securities which they were not registered to offer, allowed money laundering to occur, and traded against their own customers. The 74 page complaint includes quotes from messages sent between internal staff, including such gems as “I HAZ NO CONFIDENCE IN OUR GEOFENCING”, from the money laundering reporting officer. The complaint also mentions Bitcoin and Ethereum as commodities, in service to defining Binance’s activities as subject to CFTC’s jurisdiction. CZ reacted with “4” meaning “Ignore FUD”, and later with a longer response which recaps how much Binance has invested in compliance and cooperation with regulators. Some analysts are pessimistic about Binance’s chances against CFTC.

Coinbase has been threatened by the SEC of a possible legal action for violations of the federal securities laws. Coinbase representative went public about company’s frustration about SEC’s unclear selection of cryptoassets considered to be securities, and cited SEC’s denial to tell which specific assets traded on Coinbase platforms are securities.

Justin Sun and his companies Tron Foundation, BitTorrent Foundation and Rainberry have been sued by the SEC for violations including sale of unregistered securities (TRX and BTT) and manipulating the secondary market for TRX through extensive wash trading. A number of celebrities who were engaged to promote Sun’s projects have also been sued in the same motion for promoting TRX/BTT without disclosing the arrangement, they include Lindsey Lohan, Jake Paul, Soulja Boy, and Lil Yachty. The period for which Sun is accused of wash trading covers April 2018 to February 2019, during which time Sun allegedly provided between 4.5 million and 7.4 million TRX and instructed staff to wash trade it using two of his accounts.

Do Kwon, of Terra/Luna infamy, was arrested in Montenegro for using forged documents. Both the US and South Korea have announced their wish to extradite and prosecute him.

The second Retroactive Public Goods Funding (RetroPGF) initiative by Optimism was completed in March, with 10 million OP being distributed to 195 different projects and people that had contributed something to the Optimism or Ethereum ecosystem. The funds were distributed to recipients in three different sections, Infrastructure (received 37%), Tooling & Utilities (32%) and Education (31%). To decide how the OP would be distributed, a panel of 90 community members was formed by selecting community members using a variety of different means. Each “badgeholder” ranked the nominated projects and funds were dispersed according to a weighted average of their votes.

Arbitrum, an Ethereum Layer 2, conducted its long-anticipated airdrop, and there has been controversy about how well anticipated the conditions were by airdrop hunters. Analysis of the airdrop indicated that, despite rules to avoid giving airdrops to Sybil users, as much as 48% of the airdropped tokens went to an address that was strongly associated with at least one other address which also received the airdrop - with 22% going to advanced Sybil users who had thousands of associated addresses receiving the airdrop.

Once the tokens were airdropped their holders (those who didn’t dump immediately) became Arbitrum’s governance decision-makers. In the first proposal (AIP-1) they would decide on whether to allocate 750 million ARB (worth $1 billion) tokens to the Arbitrum Foundation, and it turned messy. Community members objected to the Foundation having discretion to spend some of these funds without on-chain community approval, and when it was clear that the proposal was in difficulty the Foundation published a blog post explaining that the vote was to ratify something that was already happening, the Foundation already had the funds and had in fact started spending them. This appears to have been a miscommunication about the nature of the vote, but following the controversy which erupted the Foundation has taken steps to reassure the community that the remaining 700 million ARB will not be touched until a proposal has been approved by the community.

This month’s record breaking DeFi hack is a good news story, because it’s the largest ever recovery of funds, by the Euler Labs team. The Euler Finance protocol was exploited by a flash loan attack on March 13, the attacker was able to obtain $197 million, and causing the value locked in Euler contracts to drop as low as $10 million. Euler Labs tried to negotiate the return of 90% of the funds with the hacker and when the negotiations broke down put out a $1 million bounty for information about the attacker. Although a deal could not be reached the attacker began to sporadically return the funds, until eventually on April 4 Euler Labs announced that all the “recoverable funds” had been returned and the bounty was cancelled.

LinksDAO is seemingly on course to achieve its main objective and buy a Links Golf Club, specifically Spey Bay on the Moray Coast of Scotland. The Club was listed for $905,000 and LinksDAO’s representatives were the top bidders, with the sale to be confirmed and the final sale price as yet unknown. LinksDAO is still reported to be on the lookout for US golf properties, as presumably not many of its 5,400 global members have easy access to the Moray Coast to play a round.

The “Skull of Satoshi”, an art installation commissioned by Greenpeace as part of a campaign to highlight the impact of PoW mining, has been adopted by the Bitcoin community as its own. The artist has come to the realization that it is not a black and white issue, as they thought it was when they began creating the piece.

Ron DeSantis, Governor of Florida, has proposed legislation to ban the acceptance of Central Bank Digital Currency (CBDC) in the state. Doubts have been raised whether the legislation is workable, it is likely that a Federal push for a CBDC could overturn pre-existing state law.

Dubai has published new laws in February that ban issuance and use of anonymity-enhancing cryptocurrencies like Monero.

Two UK banks have restricted retail customers’ access to crypto. Nationwide introduced a daily limit of £5,000 on debit-card purchases, while disallowing to use credit cards to buy crypto. HSBC has also blocked crypto purchases with its credit cards.

Nigeria has been pushing its CBDC, when incentives like discounts on taxi fares didn’t work to increase adoption they restricted access to cash to force the issue, but people are protesting about the lack of cash and still adoption of the CBDC is at less than 0.5% of the population.

That’s all for March. Share your updates for the next issue in our #journal chat room.

About

This is issue 57 of Decred Journal. Index of all issues, mirrors, and translations is available here.

Most information from third parties is relayed directly from the source after a minimal sanity check. The authors of the Decred Journal cannot verify all claims. Please beware of scams and do your own research.

Updates:

- 2023-04-27: Removed accidental report of a dcrpool pull request from 2022.

Credits (alphabetical order):

- writing, editing, publishing: bee, bochinchero, Exitus, jz, karamble, l1ndseymm, phoenixgreen, richardred

- reviews and feedback: davecgh

- title image: Exitus

- funding: Decred stakeholders