Decred Journal – August 2021

Image: Transmutive State by @saender

- Politeia v1.1.0 has been released and deployed to the proposals site, it adds new features, including expanded metadata and enhanced UI.

- The ticket price finally set a new all time high of 321, which even surpassed the spikes in Decred’s history, clearing the way to refer to new ticket price ATHs without any qualification about the early spikes in price.

- Solid progress on a range of Decred software repositories, including progress on 3 different DCPs (7, 8 & 9), and for DCRDEX the Solidity contract for ETH trading is under review on testnet.

Contents:

Development

The work reported below has the “merged to master” status unless noted otherwise. It means that the work is completed, reviewed, and integrated into the source code that advanced users can build and run, but is not yet available in release binaries for regular users.

Implementation of the Revert Treasury Expenditure Policy consensus change (DCP-7) has been merged (following some preparations to make it easier to review). If the vote passes, the spend limit will be based on the treasury’s historical income and not its historical spends, which in turn unlocks the ability to use the new decentralized treasury.

Merged work towards the Automatic Ticket Revocations consensus change (DCP-9):

- added a method to get all tickets that will expire in the next block

- unified vote and revocation validation

- added a function to create revocation tx for a given ticket

Other merged work:

- definitions for Explicit Version Upgrades consensus change (DCP-8)

- optimized precomputed math values for ~10% faster signature verification and ~400 KiB smaller

dcrdbinary - rewritten NAF conversion to avoid all heap allocations and switch to a faster algorithm, removing another ~1% from signature verification time

- added methods to create and restore snapshots of spendable coinbase outputs (will allow more efficient tests)

- added config option for maximum log file size before it is rotated and compressed

- added mixing and VSP support to

purchaseticketJSON-RPC request - added

processunmanagedticketJSON-RPC request to assign an existing ticket to the VSP configured in the user’s config file - added storing of VSP host and public key for each ticket in the wallet database (allows more efficient checking of ticket fee status)

- fixed some duplicate address watching (it was bottlenecking block processing on heavily-used wallets)

- fixed some hangs when locking or shutting down the wallet

- fixed and improved reorg handling in SPV syncing mode

- added a button to revoke tickets while in SPV mode

- replaced the gap limit setting with one-shot Discover Address Usage action (that has its own gap limit)

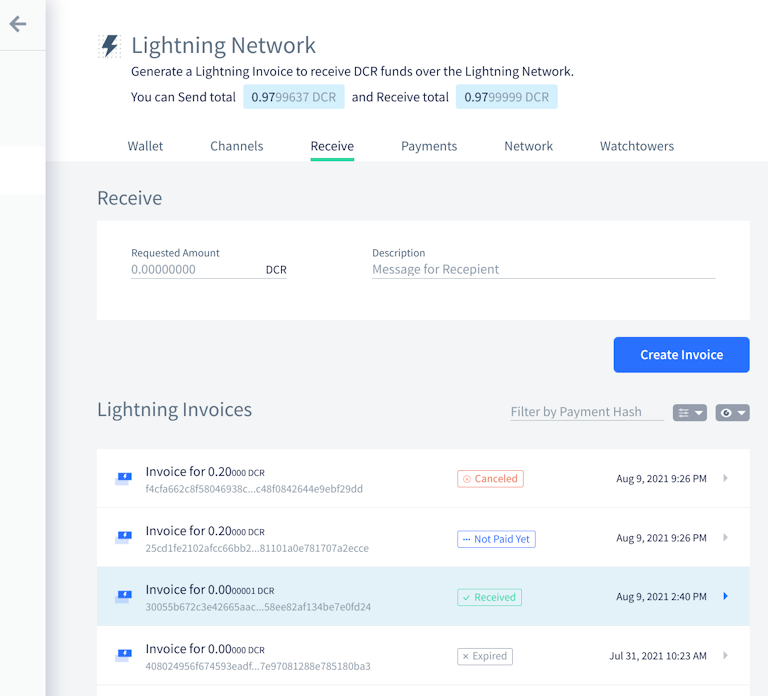

- new UI design for LN Send and LN Receive pages

Decrediton LN Receive page

Politeia v1.1.0 has been released and deployed at proposals.decred.org. Release highlights:

- proposal authors are now required to fill in funding amount, start and end dates, and domain, when submitting proposals (recent proposals like this show this new data at the top)

- combined

In DiscussionandVotingtabs into oneUnder Reviewtab to help users quickly see if any proposals are being voted on - ability to see raw Markdown

- ability to see who censored the proposal and why

- many UI/UX fixes and improvements

- email notifications are now rate limited to prevent malicious users from triggering too many of them and getting Politeia flagged as a spam server

- user database moved to MySQL in order to remove CockroachDB as a dependency and have only one database instance to manage

For more details check the release notes in politeia and politeiagui repositories.

User-facing changes merged in master (post v1.1.0):

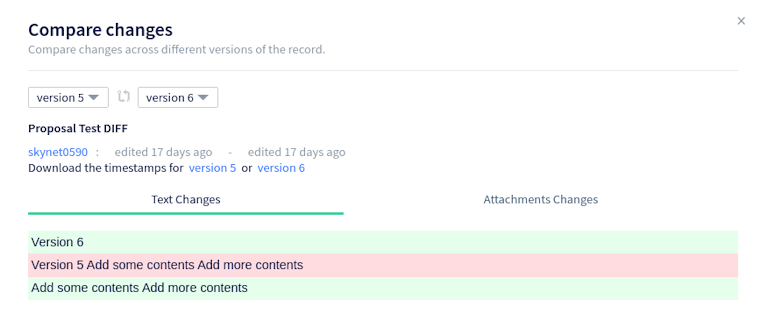

- allow the user to compare any two proposal versions

- highlight comment votes immediately but show an error if server request failed

- ~7 bug fixes

Politeia proposal differ

Backend, internal, and command-line changes (post v1.1.0):

- verify password before expensive wallet operations in

politeiavoter votecommand - human-readable currency values in

pictltool output (e.g. when submitting new proposals with it) - added CSRF protection to the login route

- added billing statuses (Active, Closed, Completed) to mark whether an approved proposal can or cannot be billed against

- require the extra data fields to be signed when posting or editing comments, and only allow that data if configured in the

commentsplugin (the purpose of these fields is to extend thecommentsplugin with new functionality) - allow proposal authors to post updates on approved proposals. Each update starts a new comment thread where users can reply and vote, until an admin marks the proposal as either Completed or Closed.

- increased test coverage

- ported signal handling improvements from other projects

- smaller fixes and maintenance

- updated to latest dcrd and dcrwallet

- added a script to generate a simulation network for testing

- added SPV support in embedded wallet mode (embedded wallet mode + SPV mode combined allow to run dcrlnd without both dcrd and dcrwallet)

User-facing:

- overhauled client credentials system. Private keys for each new DEX account are now derived from a single app seed and the server’s public key. Also, the single app password used to encrypt sensitive user data is replaced with a pair of keys where the “inner” key is encrypted with the “outer” key. This removes the need to re-encrypt all protected data when the password (and the outer key) is changed.

- added an endpoint to return app seed if supplied the correct app password

- added a checkbox to remember password for the duration of the session

- make the user aware of available markets and lot sizes before registration fee is paid

- allow clients to cancel orders while a market is suspended

- fixed scrolling issues

Internal:

- use compact filters on the client to locate counterparty contract redemptions instead of always pulling blocks to check

- do not broadcast swaps if there’s any trouble generating or signing the refund tx

- initial internationalization support on the client (in Go, HTML and JS code)

- automatically check if localized templates need to be regenerated

- fixed some shutdown hangs

- fixed and improved reorg testing

Ethereum support:

- initial version of the Solidity smart contract for ETH swaps. As the README says, it is untested and unsafe for use on mainnet and is intended as a proof of concept of ETH swaps. This PR generated a lot of knowledge about Ethereum and contract security, and brought in code testing for reentry attack vulnerability.

- added swap gas cost approximation

Most of these changes are towards the v0.3 milestone but some were backported to the v0.2.x release branch.

Check out Decred in Depth episode 42 where @chappjc answered community questions about DCRDEX and working as a Decred developer.

Merged in dcrlibwallet library (shared by dcrandroid, dcrios, and godcr):

- Politeia voting support

- a filter for fetching unmined tickets (those with no confirmations)

- function to get time till next ticket price change

Merged in dcrandroid:

- implemented dark mode

- added transaction details dialog for tickets

- updated French translation

- upgraded dependencies and migrated to Kotlin code style

- fixed “StrandHogg” vulnerability (one where malicious apps may hijack Android Tasks)

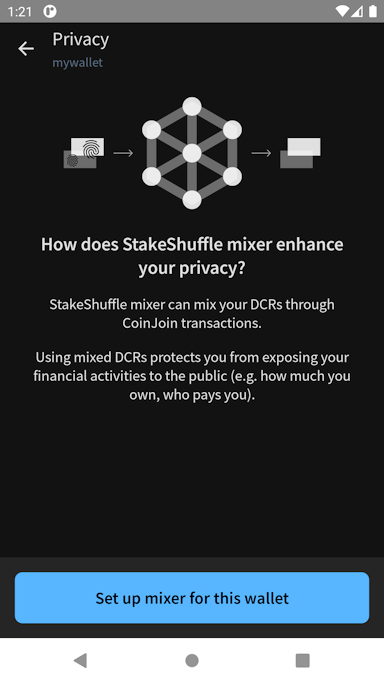

dcrandroid Privacy and Receive on the dark side

- bumped min deployment target to iOS 12

- ~2 bug fixes

- implemented Politeia voting

- more informative display of transaction lists and details

- added desktop notifications when a new incoming transaction or proposal is detected

- new system for in-app (toast) and operating system notifications

- show time till next ticket price change

- customized notifications for stake tx

- implemented back navigation

- added hover tooltips for ticket data

- introduced LinearLayout to simplify layout code

- refactoring and code cleanup

- ~20 bug fixes

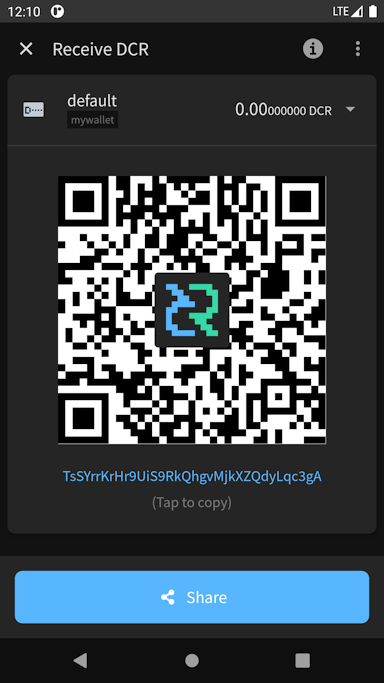

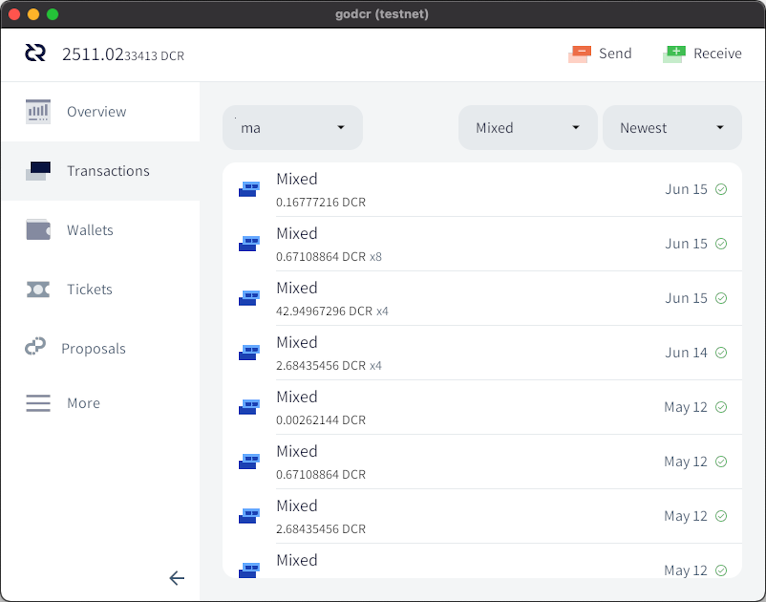

godcr Mixed filter

- migrated to the new Politeia API

- dependency upgrades and refactoring in preparation to release v6.0 branch

Other:

- Bug Bounty Program posted an update: 2 vulnerabilities have been patched and made public, and their authors added to the Hall of Fame.

People

Congratulations to new contractors granted the Decred Contractor Clearance (DCC): @vibros68!

@raedah gave an interesting interview to Authority Magazine talking about a variety of topics, his life experience, and Decred.

Can you please give us your favorite “Life Lesson Quote”? Can you share how that was relevant to you in your life?

Jiddu Krishnamurti said in some of his books, “You can’t drink the word water”, and “If the water is clean, drink it”. These were simple pointers about reality that the word or idea is not the same as the thing, and that we will need to be able to use our own judgement to determine if a thing is good instead of looking for some external authority to tell us what is true, good, or right. He gave discussions about us being our own source of authority in our lives instead of giving our power away to others or to social institutions. He was the best type of guru because he didn’t want to be anyone’s guru. He just wanted to send them away, and to hand their power back to them. The best business professionals I know also do this. Their goal is not to make the company depend on them in order to create job security, but rather to solve the problems and automate their job away so that their role is no longer needed. At that point, they can move on to solving the next challenge.

Check Media section for other new interviews with Decred community members.

Community stats as of Sep 1:

- Twitter followers: 48,161 (+575)

- Reddit subscribers: 11,597 (+148)

- Matrix #general users: 522 (+9)

- Discord users: 2,124 (+164)

- Telegram users: 2,846 (+13)

- YouTube subscribers: 4,610 (+10), views: 194K (+3K)

Governance

In August the new treasury received 10,942 DCR worth $1.76M at August’s average rate of $161.24. 845 DCR was spent to pay contractors, worth $136K at August’s rate, or $108K at July’s billing rate of $127.48. As of Sep 2, combined balance of legacy and new treasury is 713,371 DCR (129 million USD at $187.50).

There were two new proposals published in August, and they have both started voting in early September:

-

A third proposal from Monde PR to renew the PR effort by @lindseymmc for another year at a cost of $42,000.

-

A proposal from @finstreet21 to produce a series of educational videos about Decred for the Indian market, at a cost of $9,800 split across three milestones.

The two proposals submitted in July which voted in August were rejected:

-

The proposal to fund a documentary by @frizzers at a cost of $295,000 was rejected with 12.5% approval and turnout of 67%.

-

The proposal to fund participation at the Dubai Crypto Expo was rejected with 37.5% approval and a turnout of 67%.

See Politeia Digest issue 46 for more details on the month’s proposals.

Network

Hashrate: August’s hashrate opened at ~316 Ph/s and closed ~360 Ph/s, bottoming at 164 Ph/s and peaking at 413 Ph/s throughout the month.

Distribution of hashrate reported by the pools on Sep 1: Poolin 36%, F2Pool 29%, AntPool 16%, BTC.com 8%, Easy2Mine 5%, Luxor 3%, ViaBTC 1.6%, HuobiPool 1.3%, OKEx 0.14%, CoinMine 0.08%, UUPool 0.07%. These percentages are based on the 244 Ph/s attributed to known pools and do not include ~90 Ph/s from unknown miners. Distribution of 1,000 blocks actually mined before Sep 1 mostly confirmed these numbers.

Staking: Ticket price varied between 120.1-321.6 DCR, with 30-day average at 193.8 DCR (+3.1).

The locked amount was 7.23-8.12 million DCR, meaning that 54.5-61.1% of the circulating supply participated in proof-of-stake.

The ticket price went down to 120 DCR and then shot up to a new all-time high of 321.6 DCR. The staking participation also reached a new ATH of 61.1%.

VSP: On Sep 1, ~8,100 (-500) live tickets were managed by listed vspd servers and ~250 (-150) by listed legacy dcrstakepool servers. Collectively the 11 legacy and 15 new VSPs managed 21% (-1.9%) of the ticket pool. Unlisted but still active legacy VSPs managed 40 live tickets.

Nodes: Throughout August there were around 205 reachable nodes according to dcrextdata.

Node versions as of Sep 1 snapshot (252 dcrd nodes): v1.6.2 - 56%, v1.6.0 - 14%, v1.6.1 - 12%, v1.7 dev builds - 13%, v1.6 dev builds - 2.4%, v1.5.2 - 2%, v1.5.1 - 0.4%.

The share of mixed coins varied between 46.1-50.5% and crossed the 50% milestone. Daily mixed amount varied between 200-786K DCR and also set a new record.

Many new all-time highs have been nicely summarized in @bochinchero’s latest on-chain metrics recap.

Ecosystem

Welcome the new VSP at synergy-crypto.net with 0.75% fee (and extra thanks for running a testnet instance).

The following legacy VSP have been removed from public listing:

- dcr.farm - its legacy page has been redirecting to vspd since June (when it had 32 live tickets)

- stakey.net - the page has been replaced with vspd UI, but its legacy API is still up and reports how many live tickets remain (38 as of Sep 1)

raqamiya.net has shut down its legacy VSP. The closing procedure started in March when it was delisted and users were notified via email, website, and March DJ to not buy any new tickets. Raqamiya then continued to vote on existing tickets for ~4 months before closing on Aug 16. A few users missed all notices and kept assigning tickets to this VSP until the end, resulting in 11 live tickets at the moment of shutdown. This can happen with any legacy VSP because dcrstakepool has no way to reject ticket registrations (unlike the new vspd protocol).

For anyone still using legacy VSP, it is recommended to switch to vspd providers to avoid the risk of missed tickets, e.g. as a result of shutting down or if dcrstakepool stops working with the upcoming consensus upgrades. As of Sep 1, legacy VSPs managed less than 300 tickets, or 0.7% of the ticket pool.

New exchange integrations:

Hotbit Korea has delisted its DCR/KRW pair, as reported by @DecredKorea (the pair went live in Nov 2020).

Warning: the authors of the Decred Journal have no idea about the trustworthiness of any of the services above. Please do your own research before trusting your personal information or assets to any entity.

Join our #services chat to follow Decred ecosystem updates.

Outreach

Monde PR had a scaled back month after its second proposal has ended in July. @l1ndseymm kept current opportunities moving along and responded to incoming queries while working on the third proposal that starts in September.

Events

Decred became a supporter of an educational program about crypto and blockchain tech organized by the Business School of the Catholic University of Argentina and Bitcoin Argentina NGO. Decred was invited as a result of past connections between Bitcoin Argentina and our Spanish outreach team, and will be included in marketing materials (along other brands). The workshop starts on Sep 8 and will run for 10 weeks.

Media

Selected articles:

- The Suppressor part 1: War of attrition by @tacorevenge (medium)

- The future is now: Steven Wagner of Raedah Group on how their technological innovation will shake up the tech scene by Fotis Georgiadis (medium)

- One of the most profitable cryptos to mine is one you may have never heard of, and it’s up 1,300% from its 2020 low. Mining-farm CEO Josh Metnick explains the crypto, and which miners and pools to use. by Laila Maidan (businessinsider.com, paywalled (kind of))

“It’s a highly legitimate project. Relatively speaking, like in crypto years, it’s been around for a while. And there are some smart, ethical people involved in it” Metnick said.

Videos:

- Decred in Depth 41 - Stephen Palley + Gabriel Shapiro (Lexnode) + Luke Powell by @elima_iii (youtube)

- Decred in Depth 42 - Jonathan Chappelow + DCRDEX by @elima_iii (youtube)

- Decred News August - Blockchain governance in action, new network highs, exciting proposals & more! by @Exitus (youtube)

- Decred’s ticket voting system - Decred Fundamentals by @phoenixgreen (youtube)

- Tax education and Decred by @phoenixgreen (youtube)

- Decred is heating up for something big by @phoenixgreen (youtube)

- Decred Price Analysis - 4th August 2021 by Brave New Coin (youtube)

Decred was mentioned by Chris Burniske in July’s Original Sins of Crypto interview with Jason Yanowitz of Blockworks:

Jason: How do you trust though… Like, everyone is democratic, until they get power and then power corrupts. I love the concept of a DAO and I love the concept of DeFi but my biggest concern is, are we just trusting these “DeFi DAO CEOs” that they’ll decentralize and give away power?

Chris: It really depends on the genesis of the DAO. Not all DAOs are equal. This is where for me the gold standard of how a DAO was started is still Decred.

Translations:

- Decred Journal July 2021 was translated to Arabic (@arij, @abdulrahman4), Chinese (@Dominic), and Spanish (@francov_). Thank you to all translators for spreading the word!

Share your translations in our #translations chat room.

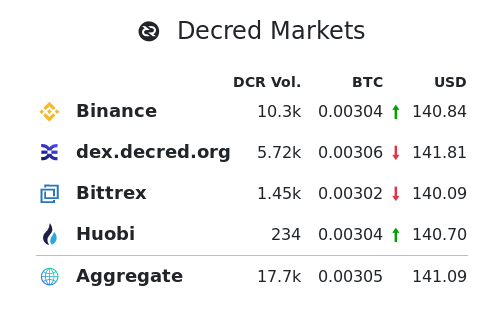

Markets

In August DCR was trading between USD 126.50-181.26 / BTC 0.0032-0.0038. The average daily rate was $161.24.

dcrdata now shows price and trading volume history for the BTC/DCR pair at DCRDEX.

DCRDEX volume finally exposed

A new mysterious contributor @tacorevenge published the first part of an investigation of The Suppressor entity that some community members suspect of manipulating DCR markets.

Odd high-volume selling

Relevant External

Some U.S. lawmakers got surprisingly selective about consensus algorithms and only excluded proof-of-work mining from the definition of “brokers” - which includes “any person who (for consideration) is responsible for and regularly provides any service effectuating transfers of digital assets”. This broad definition has been criticized as potentially applying to virtually every economic actor in the industry, and became the subject of a crypto lobbying effort to replace that language with some that is more specific and explicitly excludes all validators and software developers. There was a version of the bill which had support from a number of Senators which would have tightened the language up in this way, but due to Senate procedure no amendments were considered and the bill with the broad definition was passed on to the House of Representatives.

A16Z, a VC with stakes in many crypto networks, has published its “Token Delegate Program”. The document explains why A16Z has decided to delegate its voting rights (they hold so many tokens that decision-making would be centralized otherwise). It also explains how they choose the delegates, around 50% of their delegations are to University based organizations with the remainder to startups and non-profits.

A Uniswap proposal from Flipside crypto caused some controversy in the community as it breezed through early rounds of voting, it would have used $25M worth of UNI to generate yield that paid the Flipside team to produce “community-enabled analytics”. One of the issues raised was that the entities named to oversee the grant included people who would benefit from it. All of the other providers of analytics were unimpressed by Flipside’s attempt to get UNI to fund 8 full time employees for their company.

NFT mania reached new heights with the LOOT (for adventurers) drop, images with white text describing adventure game items on a black background, which were soon selling for upwards of 10 ETH each. The idea behind LOOT is that once the range of items and their scarcity is determined initially then people will add all of the aspects usually associated with games (visual representation of the item, stats, a game world to use it in) afterward. Little attention seems to have been given to incentivizing this work so far however, rather LOOT’s main feature at this stage seems that it entitles the holder to receive a range of similarly vacuous airdrops. Are we moving past “build it and they will come”, to “sell them some placeholders for a high price and someone is bound to show up and build it”?

Also, it looks like the LOOT drop was heavily gamed by people with expert knowledge, who were able to guarantee rare items in their bags.

A fake Banksy NFT was sold for $300,000 after the graffiti artist’s website was apparently hacked to add a page introducing this NFT and linking to its listing on Opensea. The scammer subsequently returned buyer’s ETH for unstated reasons.

That’s all we have for August. Share your updates for the next issue in our #journal chat room.

About

This is issue 41 of Decred Journal. Index of all issues, mirrors, and translations is available here.

Most information from third parties is relayed directly from source after a minimal sanity check. The authors of the Decred Journal have no ability to verify all claims. Please beware of scams and do your own research.

Credits (alphabetical order):

- writing and editing: bee, degeri, richardred

- reviews and feedback: davecgh, l1ndseymm, lukebp, matheusd

- title image: saender

- funding: Decred stakeholders