Decred Journal – September 2022

Image: Artwork by @OfficialCryptos

Highlights of September:

-

DCRDEX v0.5 public release made permissionless self-custodial trading more accessible with numerous improvements, including more wallet options that don’t require full blockchain download.

-

LTC trading pairs went live on dex.decred.org.

-

decred.org website received a batch of updates including 4 updated translations.

-

Decred Lightning Network node count and capacity are on the rise.

Contents:

- DCRDEX v0.5 Released

- LTC Trading Enabled at dex.decred.org

- Development

- People

- Governance

- Network

- Ecosystem

- Outreach

- Events

- Media

- Discussions

- Markets

- Relevant External

DCRDEX v0.5 Released

DCRDEX v0.5.3 was the first publicly announced release in the v0.5 series. v0.5 makes trading more accessible, stable, and convenient. Major changes since v0.4:

-

Built-in lightweight DCR wallet. Using dcrwallet or Decrediton in SPV mode (not full node) was already supported, but now no external wallet software is even required to trade DCR. However, users should continue with their existing Decred wallet software that has all the governance features that makes Decred great.

-

Using Electrum wallets for trading BTC and LTC. Electrum wallets have weak privacy but they are very popular and easy to use, so more people can potentially trade on DCRDEX now.

-

DCRDEX can now work with mixed account configurations when using dcrwallet or Decrediton as the external DCR wallet, allowing Decred’s privacy features to be used automatically when trading.

-

Swap options may be set at time of placement of each order rather than in the wallet settings. This includes pre-sizing funds to avoid overlocking of funds, and specifying higher network fee rates.

-

Improved send/withdraw controls, allowing a complete sweep of the wallet minus transaction fees, or sending a precise amount like most wallets.

-

QR code display for wallet receiving addresses.

-

Bitcoin swap acceleration using CPFP transactions to increase the swap fee rate in the event of a network fee spike. This has not been in demand much recently, but rapid increases in Bitcoin fee rates happened in the past where this would be valuable.

-

Fiat currency value display. When enabled by the user, current USD exchange rates for all assets will be used to show equivalent fiat values on the UI.

-

Bitcoin “descriptor” wallets are now supported. This only applies to users of the Bitcoin Core software (not the built-in BTC wallet), who also choose to create this type of wallet that is becoming the default in future versions of Bitcoin Core.

-

Rescan and recover functionality for the built-in BTC SPV wallet. You may also now reconfigure the built-in BTC wallet’s “birthday” to change the scope of the rescan (younger wallets are faster to scan).

-

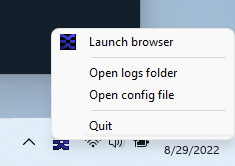

Experimental Windows build which starts the DEX client with no terminal, and with a system tray icon. This should feel more natural for Windows users.

-

Support for the latest Litecoin Core software (v0.21) that introduced MWEB (private addresses). Note: only regular addresses are used for trades.

-

Initial Zcash (ZEC) support using zcashd and unshielded addresses for trading. Note: ZEC trading pairs are not yet live at dex.decred.org.

While DCRDEX is more complex compared to traditional exchanges, it is worth noting how accessible it is as a desktop app. DEX client is a single file that requires no installation. User interface quickly loads from local files. Builds are available for Windows, macOS, Linux (x64, ARM and RISC-V CPUs) and even FreeBSD and OpenBSD.

Check the full release notes for the full list of new features, fixes, and upgrading instructions. As of writing, the latest release is v0.5.4 and it comes with standalone binaries that can be used independently from Decrediton. As always, we recommend to verify the files before running.

LTC Trading Enabled at dex.decred.org

Image: LTC pairs are live at dex.decred.org!

Some users are naturally confused by the two levels of asset support in DCRDEX:

-

A new asset is first added in “the code”. This does not automatically add new trading pairs at the official server (dex.decred.org) and this stage is not visible to its end users. Code integration is still announced though, as it’s an important milestone for those following the project, and something third party servers may experiment with.

-

After sufficient testing and preparation new pairs go live at the official server.

As of writing dex.decred.org supports trading of DCR, BTC and LTC. Third party server operators may enable additional experimental assets, currently supported: BCH, DOGE, ZEC, and ETH.

Development

The work reported below has the “merged to master” status unless noted otherwise. It means that the work is completed, reviewed, and integrated into the source code that advanced users can build and run, but is not yet available in release binaries for regular users.

dcrd

dcrd is a full node implementation that powers Decred’s peer-to-peer network around the world.

September was mostly about optimization and cleanup:

- Optimized block template generation to not fetch inputs for the coinbase transaction (one that creates new coins) because it cannot have inputs.

- Optimized memory used by transaction script copying.

- Deprecated the

--blockminsizeCLI option. It allowed to add low-fee or free transactions into a block while the block was below the specified minimum size. The policy allowing to relay such low-fee/free transactions was removed (and replaced with the Child Pays For Parent technique) and so this CLI option is no longer needed. - Reworked UTXO cache to improve its robustness, optimize it, and correct some hard to hit corner cases. This cache provides fast access to coins in circulation (aka Unspent Transaction Outputs - UTXO) and is essential for performance, because each block basically spends existing coins and creates new coins. Since it is consensus critical code, the rework was split into 19 independent changes to make it easier to review.

- Added a database migration to remove UTXOs that cannot be spent. Specifically, coins created by the

treasurybasetransaction (the 10% part of the block reward that goes to treasury) are never directly spendable and thus should not take space in the UTXO database. - Removed mempool and mining code dealing with low-fee and free tx relay policy. Related

--blockprioritysizeoption and fields in thegetrawmempoolresponse have been deprecated. - ~6 other maintenance PRs (refactoring, upgrades, cleanup).

dcrwallet

dcrwallet is a wallet server used by command-line and graphical wallet apps.

- Respect proxy config for SPV and P2P seeder connections.

Decrediton

Decrediton is a full-featured desktop wallet app with integrated voting, StakeShuffle mixing, Lightning Network, DEX trading, and more. It runs with or without a full blockchain (SPV mode).

- Upgraded dcrdex module to v0.5.2.

- Updated German translation.

- Reused media breakpoints from the pi-ui library. This removes duplicate screen size definitions from 154 files and makes them consistent with Politeia GUI.

Politeia

Politeia is Decred’s proposal system. It is used to request funding from the Decred treasury.

Backend:

- Fixed ordering of proposal author updates.

GUI remake on the new plugin architecture:

- 4+ mobile view improvements for comments, markdown buttons, proposal page etc.

- Added unit tests for app initialization.

- Fixed store errors discovered with the new tests.

pi-ui library (shared by Politeia and Decrediton):

- Improved sizes in mobile view.

- Fixed double rendering of modals.

vspd

vspd is server software for running a Voting Service Provider. A VSP votes on behalf of its users 24/7 and cannot steal funds.

- Moved vspd code to

cmddirecctory. It is the final step of removing global variables and it allows to build multiple executables from a single repository. - Made database backups optional. Backups are only required by vspd but not by test code or future upcoming tools (such as vote validator).

Lightning Network

dcrlnd is Decred’s Lightning Network node software. LN enables instant and low-cost transactions.

- Changed the policy for closing channels from an absolute policy (close all channels that don’t meet the policy conditions) to a relative policy (based on activity scoring for each channel). The policy enforcement only kicks off after the on-chain wallet balance drops below a new config parameter. The intended result is that channels will not be closed unless the liquidity provider requires coins to fund new channels, preferring to close channels with a combination of low activity during its lifetime. This is a more useful policy in the current state of Decred’s LN due to low rates of use.

DCRDEX

DCRDEX is a non-custodial, privacy-respecting exchange for trustless trading, powered by atomic swaps.

Merged in v0.5.3 release:

- Added a fallback API for getting fee info from external sources. For Bitcoin RPC wallets (like a local Bitcoin Core wallet) it will use mempool.space API.

- Fixed swap/redemption fee info and added columns for base and quote fee assets to the CSV export.

- Fixed 4 edge cases with disconnection during trades and invalid responses from the server.

- Fixed candles delta overflow bug.

- Removed default port for Electrum.

- Backported several other fixes from

master.

User-facing changes merged in master:

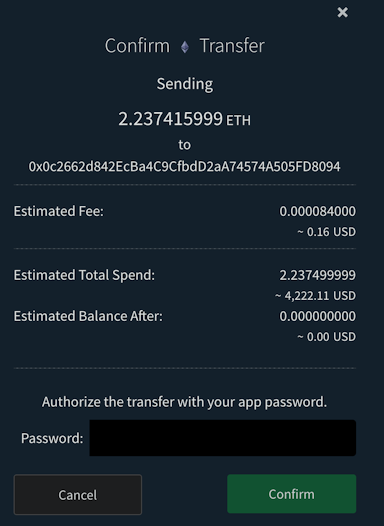

- Display estimated fees when withdrawing funds.

- Improved notifications for placed orders.

- Added a button to disable a wallet.

- Added built-in SPV wallet for Bitcoin Cash. “Built-in” means the wallet is fully managed by the DEX without the need to download/install/configure external software (the BCH wallet), while “SPV” means it works without downloading the BCH blockchain. This currently relies on a temporary fork of gcash/neutrino with extra changes needed by DCRDEX, until those changes are merged by the upstream gcash project.

- Added built-in SPV wallet for Litecoin, similar to one for BCH.

- Show recently matched orders.

- Show system tray icon on Windows, macOS, and Linux.

- Fixed incorrect market volume on Wallets page.

- Fixed confusing ordering of trade steps on the Order page and added display of future steps to expect.

- ~5 other fixes.

Internal changes merged in master:

- Replaced uses of

settxfeemethod with a more robustfee_rateargument tosendtoaddress. It is only supported with recent versions of Bitcoin Core and its clones. Wallets based on older Bitcoin Core will continue to usesettxfee(BCH, DOGE, ZEC). - Added a tool for finding missing notification translations. Also, notifications will fall back to English strings if a translation is missing.

- Clients will no longer accept signatures of truncated messages - a bug where in some places message data was not hashed before getting signed or verified. The PR explains why this bug was hard to exploit but also quite tricky to fix. This change is the last step of the 4-stage plan to roll out the fix with minimum disruption to older clients.

- ~6 other fixes.

- ~8 changes for code maintenance, testing, and documentation.

Ethereum support:

- Babysit refund and redeem transactions. Unlike UTXO coins, Ethereum’s ability to replace one transaction with another with the same nonce requires more involved tracking.

- Update fees paid after the transaction is mined. For Ethereum-based assets, the exact fee paid cannot be known in advance.

dex.decred.org landing page:

- Rewritten How to get started text.

- Added nice icons for all 6 supported assets.

DCRDEX aims to support trading with lightweight wallets, which is a massive boost to user experience compared to having to download full blockchains. For Decred it uses its native SPV protocol and for Bitcoin it relies on the Neutrino wallet from Lightning Labs (which itself is based on btcsuite - Decred’s parent). Neutrino forks for Litecoin and Bitcoin Cash are not as well maintained however, so the team has created neutrino-bch and neutrino-ltc forks where changes needed by DCRDEX can be merged quickly. As of writing, they have fixes missing in their upstream repositories for LTC and BCH.

Image: Fee estimates when withdrawing from DCRDEX.

Image: System tray icon indicates that DEX client is running.

Image: Icons for supported assets at dex.decred.org.

Documentation

dcrdocs is the source code for Decred user documentation.

- Decred’s Business Brief and Project History pages have been moved from the old Decred website to the Getting Started section of docs.decred.org.

decred.org

dcrweb is the source code for the decred.org website.

Translations:

- Translations infrastrucure received a cleanup and a GUI tool to update translations (pioneered in Decrediton), along with usage instructions.

- Added/updated Chinese, Arabic, German, and Polish translations.

Redirects for moved/deleted pages:

/briefand/historyredirects to their new locations at docs.decred.org./contributorsredirects to Decred’s GitHub org members.- Secure, Sustainable, and Adaptable pages have been removed and will show “Page not found” with a link to the home page.

Other:

- Added @richardred’s Blockchain Analysis Part 2 to Press coverage.

- ~2 other fixes.

Other

dcrwebapi (mainly used to serve the VSP list to Decrediton and decred.org):

- Added block height and estimated network proportion to the VSP response. Unlike the last updated timestamp (currently shown at the VSP list), block height allows to more accurately determine if the VSP has stalled.

- Removed unused endpoints. The one to get coin supply (

gcs) is replaced by a better maintained dcrdata API (the/supplyendpoint), while the download count (dc) was only a very rough estimate based on a quite basic heuristic. If you know anyone using these endpoints please report in issue 169.

Software translations:

- A new status page has been created to track how up-to-date Decred software translations are and where help is needed. Currently tracking Decrediton, DCRDEX and decred.org website.

People

Welcome to new first-time authors on Decred Magazine: Joao Paulo Sant’Anna da Silva and Wahid Pessarlay (who also wrote for Cointelegraph).

New personal stories and thoughts shared by Decred community members: Brian Stafford (@buck54321) on Authority Magazine, Ronnie Amato (@MadScrilla1) on Decred Magazine, and @h3la1 and @Tivra in the Community Roundtable livestream.

Can you please give us your favorite “Life Lesson Quote”?

Take a breath. [@buck54321]

If applicable, is there anything the community can do to aid you in your work?

Keep me honest. Challenge my assertions & criticisms. Play devil’s advocate & reach out to me for any reason, especially if you are interested in organizing Meet Ups. I could be open to travel & hosting. [@MadScrilla1]

Community stats as of Oct 1 (compared to Sep 1):

- Twitter followers: 54,019 (-732)

- Reddit subscribers: 12,637 (-10)

- Matrix #general users: 720 (+6)

- Discord users: 1,821 (+25)

- Telegram users: 2,891 (+7)

- YouTube subscribers: 4,650 (+10), views: 215,726 (+1,444)

Governance

In September the new treasury received 8,848 DCR worth $241K at September’s average rate of $27.19. 3,089 DCR was spent to pay contractors, worth $84K at September’s rate, or $99K at August’s billing rate of $31.93.

The treasury spend transaction was mined on Sep 24, it had 28 outputs ranging from 1 DCR to 961 DCR. The transaction was approved with 6,856 Yes votes and 0 No votes.

As of Oct 10, combined balance of legacy and new treasury is 817,745 DCR (20.9 million USD at $25.51).

There were no proposals published on Politeia in September, but a new PR proposal from @lindseymmc was published on Oct 1.

A proposal idea was posted on Reddit suggesting a partnership between FIO Protocol and Decred, it is not asking for funding but instead offering to pay an integration grant to whoever would do the work to integrate FIO within Decred software. FIO is an Interwallet Operability initiative with its own token.

An update was posted on the Politeia proposal (missed in August) announcing that the site was updated to v1.4.0, with most of the work going into the importing of legacy Git backend proposals into Trillian, along with some new features like allowing edits to comments within 5 minutes of their posting.

Network

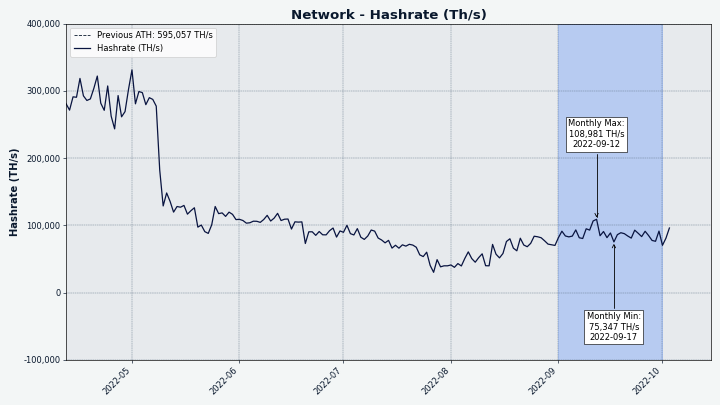

Hashrate: September’s hashrate opened at ~82 Ph/s and closed ~91 Ph/s, bottoming at 75 Ph/s and peaking at 109 Ph/s throughout the month.

Image: Decred hashrate.

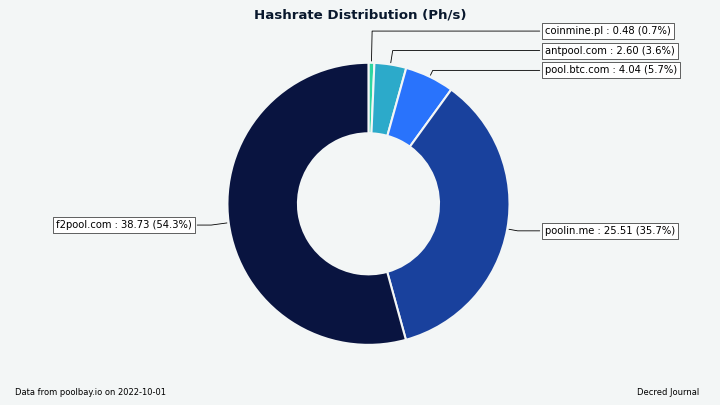

Distribution of 71 Ph/s hashrate reported by the pools on Oct 1: F2Pool 54%, Poolin 36%, BTC.com 6%, AntPool 3.6%, CoinMine 0.7%, unknown 0.3%.

Distribution of 1,000 blocks actually mined by Oct 1: F2Pool 49%, Poolin 44%, BTC.com 4%, (likely) AntPool 3%, CoinMine 0.3%.

Image: Pool hashrate distribution.

Staking: Ticket price varied between 221-239 DCR, with 30-day average at 229.1 DCR (-1.1).

The locked amount was 9.28-9.43 million DCR, meaning that 64.1-64.9% of the circulating supply participated in Proof of Stake.

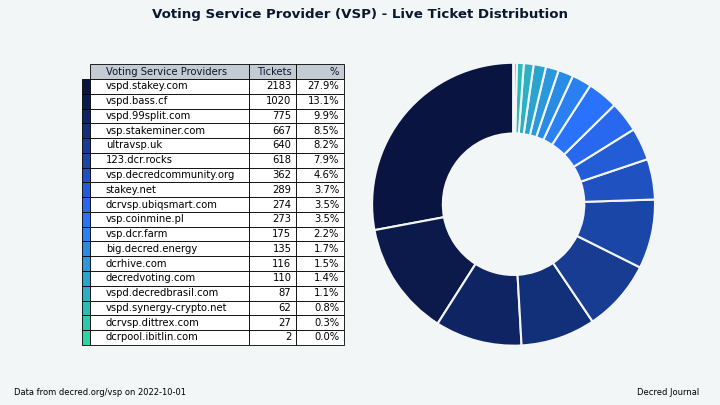

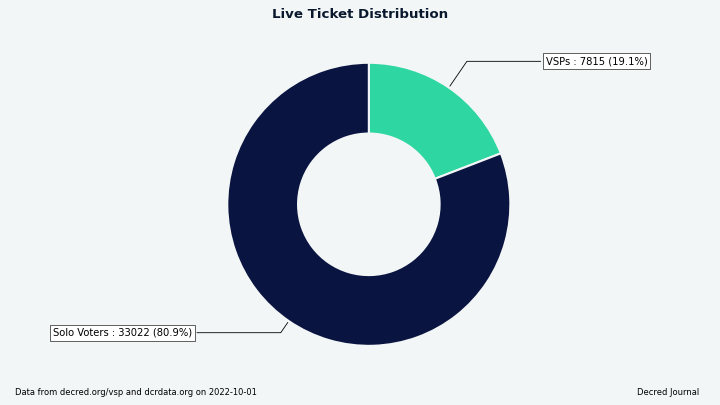

VSP: The 18 listed VSPs collectively managed ~7,820 (+770) live tickets, which was 19.1% of the ticket pool (+1.8%) as of Oct 1.

Biggest gainers in September are vspd.bass.cf (+726) and vspd.stakey.com (+443). Note that the latter had API issues since Sep 20 and the ticket stats it reported were inaccurate.

Image: Distribution of tickets managed by VSPs.

Image: Distribution of solo vs VSP-managed tickets.

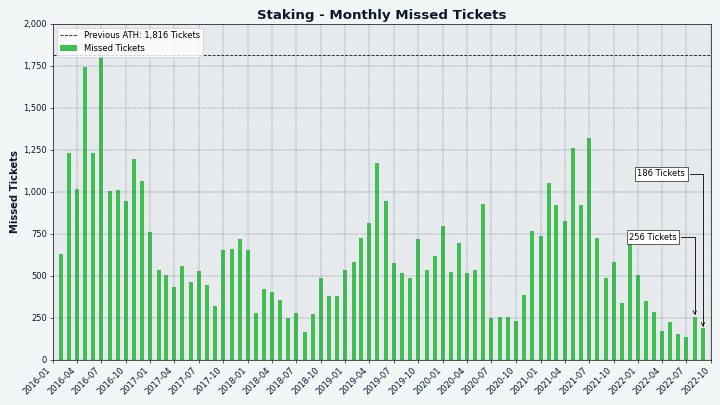

Image: Monthly missed tickets since 2016.

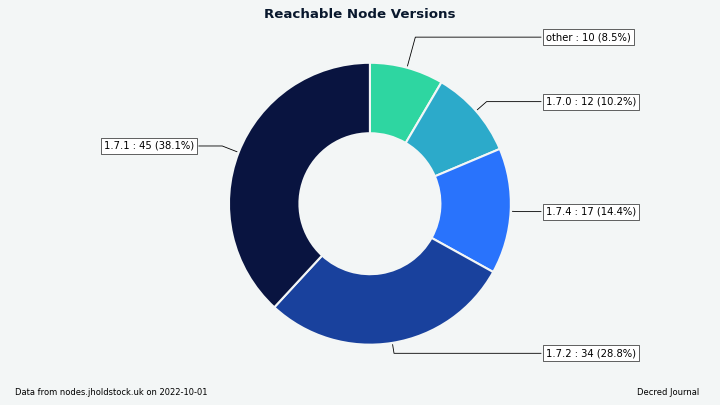

Nodes: Decred Mapper observed 118 dcrd nodes on Oct 1: v1.7.1 - 38%, v1.7.2 - 29%, v1.7.4 - 14%, v1.7.0 - 10%, other - 9%.

Note: dcrd v1.7.4 was a source-only release for developers with the main goal to fix the stalled testnet.

Image: dcrd node version distribution.

The share of mixed coins varied between 60.8-60.9%. Daily mixed amount varied between 290-493K DCR.

Decred’s Lightning Network explorer has seen 70 nodes (+28), 105 channels (+37) with a total capacity of 42.5 DCR (+7.1), as of Oct 1.

Thanks to @bochinchero for making DJ less boring with the charts. You can find the charts we cherry-pick here and many others in the dcrsnapshots repository.

Ecosystem

KuCoin was removed from the Exchanges list after a report that it did not accept DCR deposits. Two weeks later they announced that DCR deposits and withdrawals are enabled.

Huobi announced it will delist 7 privacy coins including DCR to “safeguard our users’ assets”, and was removed from the Exchanges list as well.

Cryptohunt added a page for Decred. The service aims to make crypto more accessible to newcomers by providing simple info pages for popular crypto projects.

Warning: the authors of the Decred Journal have no idea about the trustworthiness of any of the services above. Please do your own research before trusting your personal information or assets to any entity.

Join our #ecosystem chat to follow Decred ecosystem updates.

Outreach

Monde PR’s achievements:

- Pitched 1 news update.

- Secured 1 media interview.

- Responded to 3 requests for comments.

Secured the following news articles:

- @buck54321 was featured in Authority Magazine’s series on the future of money and banking. The piece includes a deep dive on DCRDEX and the benefits of P2P, along with points on the Lightning Network, the importance of self custody, and decentralization.

- @jz was quoted in Axios, on how the future of cryptocurrency includes strong privacy guarantees, in response to Huobi Global delisting DCR and six other privacy coins.

Events

Attended:

Paul Rosenberg mentioned Decred at Hackers Congress Paralelni Polis (Prague, Czech Republic). It was a small appearnace on one slide but with an important idea:

BTC, BCH, Decred, Scrit, whatever.. Use it.

Start publishing prices in sats; let people learn how to convert.

Setup middlemen if you like.

Take a year to transition if necessary, but we must use our money.

Media

Decred Magazine engagement stats for September:

- Total number of articles on DM: 318

- Newsletter subscribers: 66

- New posts and newsletters sent: 13

- Active social media campaigns: 12

- Social media posts: 151

- Likes: 662

- Re-tweets: 114

- Social media followers across all platforms and accounts: 973

Twitter users can support @Decredmagazine with follows, likes and retweets to help spread the message.

DM is also coming to Instagram - follow @decredmagazine.

Selected articles:

- Stablecoins on Decred by Anon - concept paper posted on Decred forum in 2018, resurrected on DM

- Brian ‘Buck’ Stafford of Decred on the future of money and banking by Jason Hartman for Authority Magazine

- Light at the end of the tunnel - DCR technical analysis by @Applesaucesome

- Monde PR August 2022 by @phoenixgreen

- Introducing Decred community member Ronnie Amato by @phoenixgreen

- The one where everything looks bad but I post lots of hopium - DCR technical analysis by @Applesaucesome

- Rio de Janeiro aims to become a crypto capital by @João

- Decred releases DCRDEX v0.5 making secure atomic swap-powered trades more accessible - press release at decred.org

- Decred pushes for highly convenient P2P atomic swaps with DCRDEX v0.5 by Wahid Pessarlay

Videos:

- Decred Community Roundtable - DAOs, governance, marketing, DEX & more by @Exitus and @phoenixgreen, featuring @WasPraxis, @h3la1, and @MadScrilla1

- Decred Monthly Recap - New website, dev updates, Politeia 1.4.0, articles + interviews & more! by @Exitus

- DCRDATA market page - Decred Fundamentals by @phoenixgreen - also as a text post

- DCRDEX added Litecoin atomic swap decentralized exchange - animation by @karamble

- Why does Decred have its own exchange? - DCRDEX Series by @phoenixgreen - also as a text post

Art and fun:

- @fjsixfjdksfi made a second track (+ a looped version) in the Open Beats series, available for free use in Decred-related content (missed in June)

- Decred the armoured lizard by @OfficialCryptos

- @richardred made the most accessible 1-min explaier how DCRDEX works featuring DEX Flow by @GhostWridah - also on Twitter

Translations:

- Decred Journal July-August 2022 got a total of 4 new translations. Thanks to @arij (Arabic), @Dominic (Chinese), and @kozel (Polish)!

Non-English content:

- Coin des tages: Decred (DCR) by KryptoZenny (“Coin of the Day: Decred (DCR)”)

- Decred Deepdive: Was steckt hinter der crypto? by TaiikN Crypto (“Decred Deepdive: What is behind the crypto?”)

Discussions

Five community members discussed governance, marketing, DEX and many other topics in the new Community Roundtable episode on Decred’s YouTube channel.

Selected Reddit posts:

- Partnership between FIO Protocol and Decred - the proposal was reposted because it didn’t meet Politeia’s criteria of having a team who will do the work. @sirashtvm answered questions how the FIO protocol works on Reddit and also on Matrix.

- Listing of Decred on Phemex exchange - another partnership idea by @sirashtvm where DCR would be listed on Singapore-based Phemex exchange, also discussed on Matrix. The main point of contention was the $30K “marketing fee” required by Phemex to fund trading competitions ($20K) and “KOL Influencer Campaign + AMA” ($10K). The idea has ended when it became known that Phemex representative is not interested in further discussion.

- Weekly Contributions - Special Edition - bounty pool has grown to 4 DCR and @fjsixfjdksfi continues to iterate on the format and rules. This edition was focused on (but not limited to) promiting the new Litecoin pairs on DCRDEX.

Selected Twitter discussions:

Markets

In September DCR was trading between USD 23.30-34.70 / BTC 0.00124-0.00175. The average daily rate was $27.19.

The following is not investment advice.

New market coverage by @Applesaucesome: Light at the end of the tunnel and The one where everything looks bad but I post lots of hopium.

I won’t sugar coat it, everything look really bad. Stonks, crypto, everything. All the momentum gained from past weeks is retraced. But as we all know, that’s where all the hands get shaken out…or we just capitulate again for the nth time. 🙃 [2022-09-25]

Image: “Decred’s BTC pairing is really interesting to watch when you zoom way out.” - @Applesaucesome

On YouTube technical analysis for DCR has been made by More Crypto Online (“it is one of the best altcoin charts out there but there is no guarantee for it to work out”), Jacob Crypto Bury, and Schulz & Team Analytik (German).

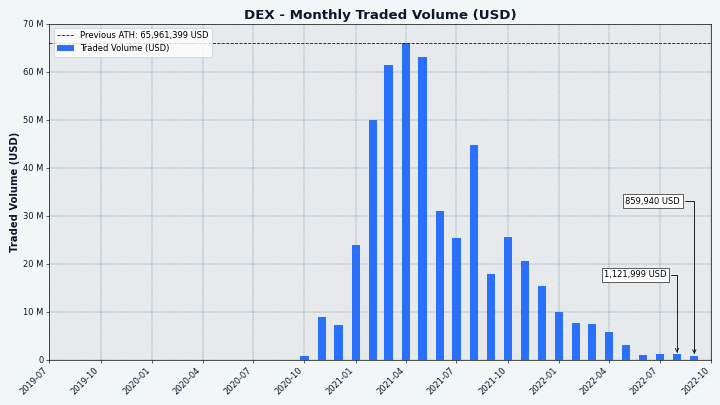

Image: DCRDEX monthly volume in USD.

Relevant External

OFAC has clarified how the sanctions against the Tornado Cash addresses are supposed to work. The people who received unsolicited nominal sums from Tornado Cash (someone was trolling) are technically in breach of the sanctions but they can fill in a blocked property form to avoid prosecution.

Coinbase is coming after Georgians who took advantage of a bug which saw the Georgian Lari mispriced for 7 hours and traders getting 100 times the Lari for their crypto. Coinbase contacted their banks and had their accounts locked pending clawback of the withdrawn funds.

Ethereum completed “the merge” to switch from PoW to PoS consensus, cutting its energy use by an estimated 99.95% and reducing the issuance rate of new ETH in the process.

The Commodity Futures Trading Commission (CFTC) has filed a complaint against Ooki DAO for violating the Commodity Exchange Act. A $250,000 penalty was imposed on bZeroX LLC, who tried to circumvent enforcement by decentralizing control of the protocol to Ooki DAO. Now the CFTC has indicated that they are coming after anyone who is involved in Ooki DAO, which it describes as an “Unincorporated Association”. It appears that Ooki DAO token holders are afraid to vote on proposals about how to respond, lest they open themselves up to more individual trouble by voting, and there is a danger they may lose by default if the DAO does not respond by Oct 14.

A merger between two DeFi communities (FEI and RARI) is being dissolved after an acrimonious split over how to compensate victims of Fuse, a DeFi product of their shared venture which was hacked for $80 million. In the aftermath of the hack an initial governance proposal was approved to fully compensate all victims, but FEI’s leadership (who had the funds to make victims whole) decided it wasn’t a proper proposal and did not follow through. It took 4 proposals to reach a solution all parties could agree to, and it involved dissolving the partnership between the projects and giving token holders a way to exit.

That’s all for September. Share your updates for the next issue in our #journal chat room.

About

This is issue 51 of Decred Journal. Index of all issues, mirrors, and translations is available here.

Most information from third parties is relayed directly from the source after a minimal sanity check. The authors of the Decred Journal cannot verify all claims. Please beware of scams and do your own research.

Credits (alphabetical order):

- writing, editing, publishing: bee, bochinchero, Exitus, jz, l1ndseymm, phoenixgreen, richardred

- reviews and feedback: davecgh, jholdstock, karamble

- title image: OfficialCryptos

- funding: Decred stakeholders