Decred Journal – May 2023

Image: Cyberstorm by @Exitus

Highlights of May:

-

DCRDEX v0.6.1 has been released, with DigiByte support and important fixes for LTC and ZEC.

-

The Decred Vanguard proposal was approved and the community-driven social media outreach program has already started.

-

Bison Relay has been making progress, with a first version of pages being merged as well as the merchant tools for Stores.

Contents:

- DCRDEX v0.6.1 Release

- Development

- People

- Governance

- Network

- Ecosystem

- Outreach

- Events

- Media

- Markets

- Relevant External

DCRDEX v0.6.1 Release

This DEX release features:

- Initial DigiByte (DGB) support (requires a full node wallet running alongside)

- Important fixes for Litecoin (LTC) and Zcash (ZEC)

- Rate of an order in Your Orders table is easier to see now

- Chart candle size is now remembered and the default size changed to 1 hour

Get the latest DEX client as a standalone app, or as part of Decrediton, or install it from Decred’s custom Umbrel App Store. As always, we recommend to verify the files before running.

Development

The work reported below has the “merged to master” status unless noted otherwise. It means that the work is completed, reviewed, and integrated into the source code that advanced users can build and run, but is not yet available in release binaries for regular users.

dcrd

dcrd is a full node implementation that powers Decred’s peer-to-peer network around the world.

Changes merged in master towards future releases:

- Cleaned up several functions by removing error states which no longer occur.

- Last August, in order to combat ASIC attacks on the testnet and ensure CPUs will always be able to mine new testnet blocks, the testnet was updated so that the testnet mining difficulty is throttled by a maximum value. This month, the mining template generator and CPU miner were updated to remove the old testnet logic that no longer applies, since all new testnet blocks enforce difficulty throttling.

- Removed a deprecated internal method which listed subscribed clients waiting for blockchain updates. Since this method was internal, it never needed to be shared outside of dcrd.

- A bug was discovered via dcrdata where the total coin supply calculation returned from the dcrd RPC server did not include the new

TreasuryBases- the part of each block’s reward that flows into the new decentralized treasury. The total coin supply calculation has now been updated, which also included an update to the database. It should be noted that this bug was only a minor error with the RPC coin supply calculation, and did not affect consensus in any way.

In progress:

- Implementing DCP-11 PoW hash consensus vote.

dcrwallet

dcrwallet is a wallet server used by command-line and graphical wallet apps.

Backported changes ready for the next v1.7.x release:

- Respect proxy config for SPV and P2P seeder connections. This is to prevent leaking internal network details.

Changes merged in master towards future releases:

- Use the latest versions of several dcrd modules and a few third party dependencies.

- Allow the wallet to follow the DCP-12 hard fork if it is approved and activated.

- Removed several deprecated internal methods, namely those made obsolete by the consensus changes DCP-9 (Automatic Ticket Revocations) and DCP-10 (Change PoW/PoS Subsidy Split to 10/80).

Decrediton

Decrediton is a full-featured desktop wallet app with integrated voting, StakeShuffle mixing, Lightning Network, DEX trading, and more. It runs with or without a full blockchain (SPV mode).

In progress:

- Ledger support: adding low-level functions and UI views.

- Since staking is not currently possible with any hardware wallets, staking views will be removed to avoid confusion.

- Added Ledger icon to the pi-ui shared library.

Other:

- Decrediton has been added to the winget package repository. Windows user can now install it with

winget install Decred.Decrediton.

vspd

vspd is server software used by Voting Service Providers. A VSP votes on behalf of its users 24/7 and cannot steal funds.

- Copied and adjusted automatic VSP fee payment from dcrwallet to vspd repository. This code was private in dcrwallet but in vspd it can be consumed by other software, which will be utilized by DCR staking integration in DCRDEX.

Lightning Network

dcrlnd is Decred’s Lightning Network node software. LN enables instant and low-cost transactions.

- Added support for custom connection for dcrwallet. It allows LN code to configure dcrwallet to connect to SPV peers using a proxy server.

cspp

cspp is a server for coordinating coin mixes using the CoinShuffle++ protocol. It is non-custodial, i.e. never holds any funds. CSPP is part of StakeShuffle, Decreds privacy system.

- Prevent duplicate inputs earlier in the mixing process. Before this fix double spends would trigger an error when sending the mix transaction, it could fail a mixing session and avoid blame assignment.

- Improved logging of mixing sessions to always capture session ID, run number, and denomination value of mixed outputs.

- Prevent CoinJoin transactions from exceeding mempool size limits. This may exclude some peers from a mix, if that happens the server will attempt to pair them in the next mixing epoch. A check has been added to retry the session if the number of peers drops below the minimum setting.

DCRDEX

DCRDEX is a non-custodial, privacy-respecting exchange for trustless trading, powered by atomic swaps.

Changes included in v0.6.1 release:

- Set high enough Zcash transaction fee rate. DEX calculates fees based on transaction size, but Zcash is an exception as it currently uses a standard fee of 1,000 zats or 0.00001 ZEC per transaction, regardless of size. This will change when ZIP 317 activates, resulting in higher fees. To ensure DEX transactions are always relayed and mined, this change bumps fees to be around 0.0002-0.0003 ZEC. A hard-coded fee rate of 84 zats/byte is used as a workaround for Zcash not having an easy way to estimate fees.

- Added DigiByte trading support with full node wallets.

- Added block explorer links to ZEC transactions.

- Added compile time option for the interval at which DEX server polls for new blocks of Bitcoin-like assets. It allows to use slower polling for remote nodes where the default 1-second interval would be too fast.

- Fixed failure to reconfigure a disconnected Bitcoin-like wallet in certain circumstances.

- Fixed Bitcoin-like wallets always requiring a restart and not having a chance for live reconfiguration.

- Fixed full restart not being triggered in some scenarios of changing RPC connection config.

- Fixed incorrect transaction ID shown when sending ZEC.

- Fixed several issues with bonds for ZEC and non-SegWit assets.

- Backported ~22 fixes and improvements made in

masterbefore May.

All other changes below are merged in master towards future releases.

Client:

- Added expected refund time to the Matches card. Previously it could show a confusing

<Pending>for hours. - Automated more wallet enable/disable steps. Disabling chain’s primary asset wallet will also disable all token wallets for that chain. Enabling a token wallet will also enable chain’s primary asset wallet.

- Optimized request handling by minimizing expensive calls to load user information.

- Restored colored logging of HTTP requests to stdout.

- Utilize external fee rate sources in SPV mode. Before this change it was possible to pay unreasonably high fees when sending from an SPV wallet.

- Removed requirement to enter a password when canceling an order.

Bitcoin:

- Fixed issues: simnet wallet could attempt to connect to mainnet, Bitcoin-like wallets always require a restart, reconfiguring a disconnected wallet could fail in certain circumstances.

Ethereum:

- Made token approvals a separate manual step instead of an automatic part of the first swap. In order to trade tokens (such as USDC) the swap contract must be approved to handle tokens on behalf of the user. Making it a manual action allows users to be aware of what is happening and not be surprised by the high fee of their first swap. An approval can be later revoked in wallet settings.

Firo:

- Added full node wallet support for Firo (formerly known as Zcoin).

- Up next is support for Firo light wallets based on Electrum.

App packaging:

- Introduced a new executable

dexc-desktopthat wraps the DEX web app in a WebView component to look like a desktop app. The app will keep running in the background if there are active orders (but can be force-closed using the--killswitch on the command line). - Added script to build Debian packages.

Developer and internal changes:

- Updated npm dependencies.

- Moved the market making bot logic out of the

Corepackage into its own package. This is needed to improve architecture and add more bot strategies in the future. - Enabled the makezero linter to detect more bugs in memory allocation.

- Updated build and test workflow to add Node.js v20 and remove v16. Node.js v16 will reach end-of-life in September 2023.

- Changed chain tip and peer tracking goroutines to shutdown more cleanly.

Image: DEX’es swap contract requires a one-time approval to swap your tokens.

Image: Solar setup running Umbrel with DEX market maker + arbitrage. By @busyLightz.

dcrdata

dcrdata is an explorer for Decred blockchain and off-chain data like Politeia proposals, markets, and more.

- Fixed numbers being slightly off on the address balance charts due to not filtering out sidechain and invalid outputs.

Bison Relay

Bison Relay is a new social media platform with strong protections against censorship, surveillance, and advertising, powered by Decred Lightning Network.

All work reported below is merged to master towards the next release (likely v0.1.8).

GUI and CLI apps:

- Implemented initial version of the Pages feature. Pages allow to browse static content from a remote user. Only Markdown pages are supported. Pages can link to other users’ pages using

br://links. Limitations of the first iteration are listed in the pull request. Pages is a big feature that will need rounds of improvements in response to user feedback. - Improved tip retry strategy. Instead of making multiple parallel attempts at paying tips for one user, only a single one is tried at a time. This should help avoid problems with tip payments failing due to LN nodes with low capacity. Also tip attempts failed for having no LN route will be retried (this error may be temporary). CLI app can list running tip user attempts with the new

/runningtipscommand. - Added ability to connect the embedded dcrlnd through the configured proxy server (such as Tor) to both the CLI app and the GUI app. New

circuitlimitconfig parameter allows to limit the number of open connections when using proxy. - Added handshake feature that allows users to test that their encryption ratchets are still working.

- Implemented persistent chat history that remembers last 500 messages and shows them after restarting the app. All chats are stored in log files but accessing history from the app itself is better UX and has been a frequent feature request. The plan is to eventually add on-demand loading of history as the user scrolls back in time.

- Fixed possible broken ratchets when two users simultaneously attempt to exchange keys with each other. This could happen when two users are added to two different group chats where the other user already exists, which initiates two key exchanges at the same time.

GUI app:

- Added context menu to individual chats and group chats.

- Added a floating button to jump to recent messages.

- Restricted size of embedded images shown in chats and posts. Bigger image is shown if clicked. This fixes issues with scrolling and different image sizes.

- Fixed some issues with text selection, added height limit to code blocks and made code blocks scrollable. Two Flutter widgets have been forked and patched to work around the issues, but double click (select word) and triple click (select paragraph) still don’t work.

- Fixed scrollbar issues on LN management views.

- Smaller fixes for scrolling and overflow behavior.

CLI app:

- Enabled brclient to delegate Pages and Store requests to another program via the clientrpc API, and forward its responses back to requesting BR users. This flexibility will enable useful features in the future.

- Enabled brclient to delegate requests to a HTTP or HTTPS website. This allows BR users to access HTTP/HTTPS resources through another BR user who acts as a proxy.

- Sort posts by most recent activity. Also unread posts will be highlighted with a different color.

- Allow to use the

/closechannelcommand with a short prefix of the channel ID (full ID is 64 characters long).

Stores progress:

- Implemented merchant-side foundations for simple Stores. Unlike Pages, Stores are dynamic resources that can present product items for sale. Store has a front page and individual product pages that are generated from local files. Store is reloaded automatically when its files change. BR client running the store can serve product pages, maintain shopping carts, handle order placements, and create invoices. Prices will be shown in USD but paid in DCR. Exchange rate is fetched from dcrdata. DCR amount to be paid is locked for 60 minutes while the order is valid. CLI app only supports on-chain payments.

- Implemented simple forms. Forms can be viewed, filled and submitted by store customers to add items to the shopping cart or to place an order.

- Added shipping details to orders. Some products may require to fill shipping info.

Other:

- Added end-to-end performance tests.

- @JC made an onboarding event in #trading with a giveaway of 20 prepaid invites with 0.05 DCR each.

People

Community stats as of Jun 2 (compared to May 3):

- Twitter followers: 53,108 (+31)

- Reddit subscribers: 12,723 (+22)

- Matrix #general users: 774 (+11)

- Discord users: 1,590 (+17), verified to post: 634 (-287) - Discord was unbridged and got stronger verfication rules

- Telegram users: 2,470 (-38)

- YouTube subscribers: 4,640 (+10), views: 229.6K (+1.5K)

Governance

In May the new treasury received 8,088 DCR worth $139K at May’s average rate of $17.13. 3,591 DCR was spent to pay contractors, worth $62K at same rate.

A treasury spend tx was approved with 6,722 Yes votes and 52% turnout, and mined on May 20. It had 23 outputs making payments to contractors, ranging from 4 DCR to 1,464 DCR. Most of this DCR was likely paid for March work, at its billing exchange rate of $20.69 the TSpend is worth around $74K.

As of June 17, combined balance of legacy and new treasury is 858,136 DCR (12.1 million USD at $14.08).

Proposals approved in May:

-

Decred Vanguard proposal was approved for a budget of $46,784 to fund growth of a community driven outreach program, with 94% Yes votes and turnout of 39%.

-

BTC-ECHO proposal was approved for a budget of $9,500 for a three month trial with German crypto site BTC-ECHO.de during which they produce two sponsored articles, with 69% Yes votes and turnout of 32%. Prior to the vote it was edited to include additional promotion on their social media and a 2-week ad on their podcast. Second edit clarified that they do not require upfront payment and agree to wait for the payment for up to 60 days after the campaign has ended, in line with how most existing proposals and contractors operate. After the proposal was approved they posted an update about next steps and the timeline.

Proposals submitted in May:

- DCRDEX Mesh Beginnings and Bonds Evolution requested $164K to develop experimental version of DCRDEX based on a server mesh architecture.

See Politeia Digest issue 60 for more details on the month’s proposals.

Network

Hashrate: May’s hashrate opened at ~74 Ph/s and closed ~66 Ph/s, bottoming at 61 Ph/s and peaking at 88 Ph/s throughout the month.

Image: Decred hashrate

Distribution of 67 Ph/s hashrate reported by the pools on Jun 1: Poolin 40%, F2Pool 40%, AntPool 16%, BTC.com 5%.

Distribution of 1,000 blocks actually mined by Jun 1: F2Pool 40%, Poolin 35%, AntPool 17%, BTC.com 8%.

Image: Historical pool hashrate distribution

Staking: Ticket price varied between 173-334 DCR.

Image: Ticket price made another swing

The locked amount was 9.38-9.90 million DCR, meaning that 61.7-65.1% of the circulating supply participated in Proof of Stake.

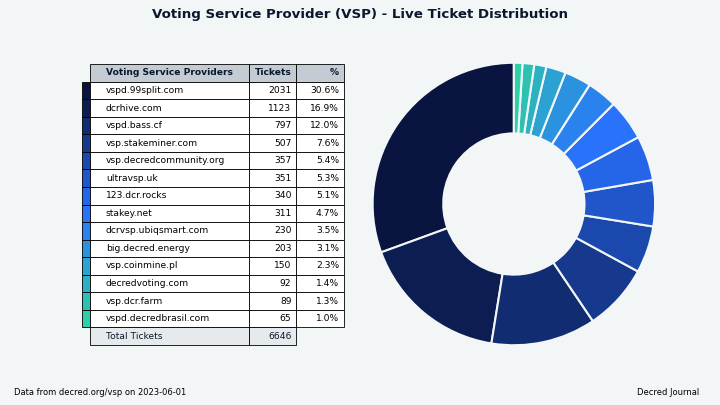

VSP: The 14 listed VSPs collectively managed ~6,650 (-310) live tickets, which was 16.8% of the ticket pool (0.3%) as of Jun 1.

Image: Distribution of tickets managed by VSPs

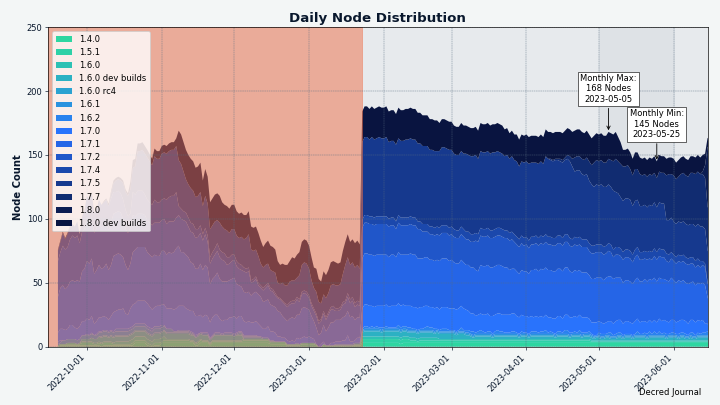

Nodes: Decred Mapper observed 147 dcrd nodes on Jun 1 of the following versions: v1.7.7 - 25%, v1.7.1 - 21%, v1.7.5 - 18%, v1.7.2 - 10%, v1.8.0 dev builds - 9%, v1.7.0 - 7%, v1.7.4 - 3%, other - 8%.

Image: Historical dcrd version distribution, data from nodes.jholdstock.uk. Data before Jan 2023 was incomplete.

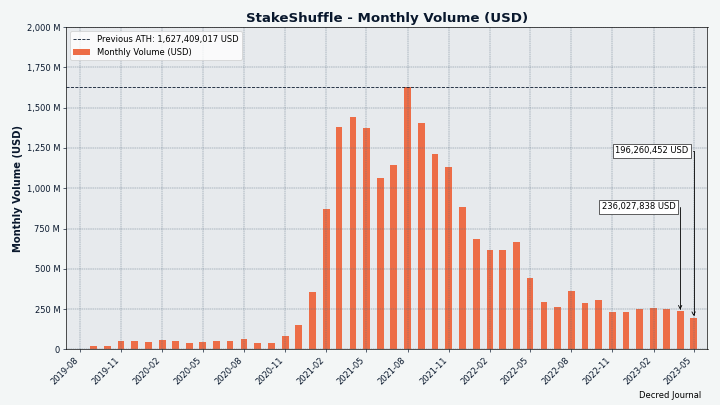

The share of mixed coins varied between 61.8-61.9%. Daily mixed volume varied between 143-497K DCR.

Image: Monthly StakeShuffle volume in USD

Decred’s Lightning Network explorer has seen 211 nodes (+15), 423 channels (+24) with a total capacity of 176 DCR (+13), as of Jun 1. These stats are different for each node. For example, @karamble’s node reported 210 nodes (+17), 446 channels (+17) and 182 DCR (+9) capacity on same day Jun 1.

Image: Decred’s Lightning Network capacity

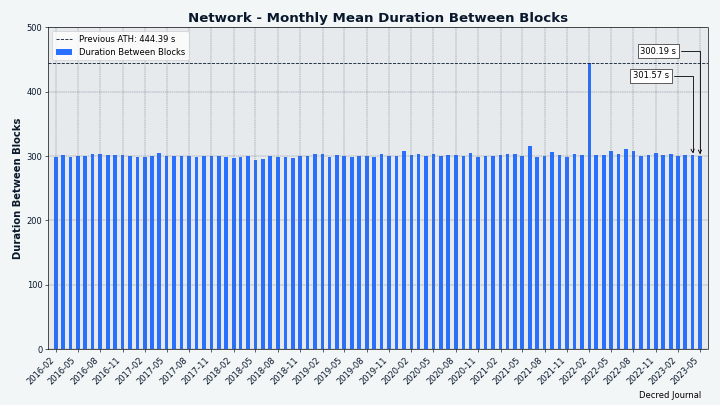

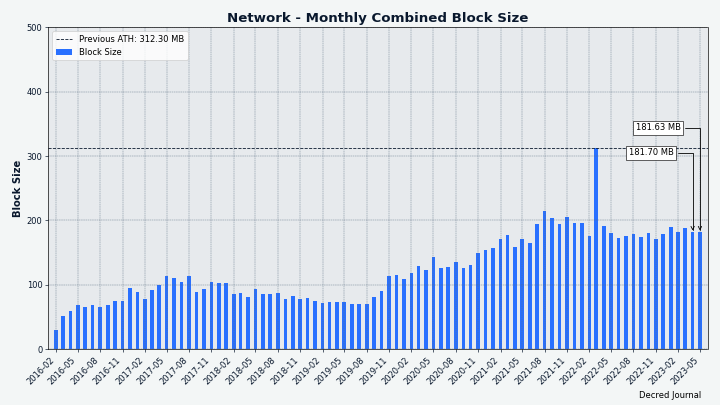

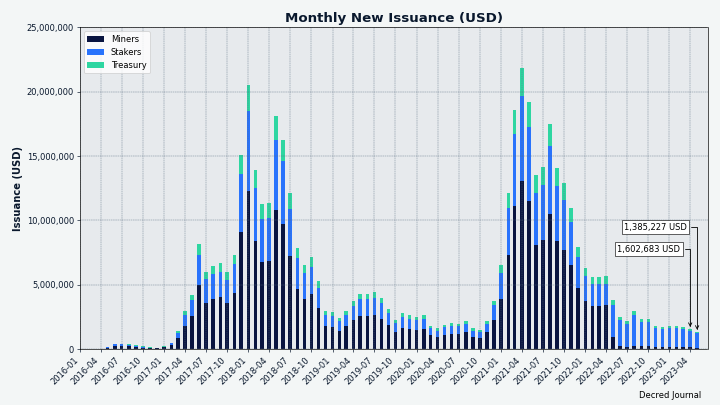

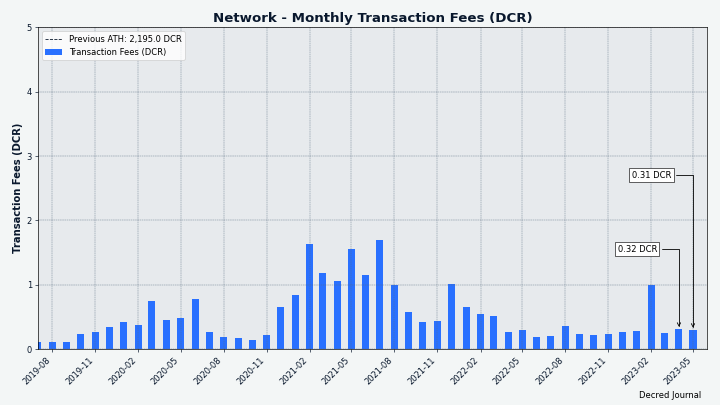

And a few new charts from @bochinchero:

Image: Average block time remains stable at 5 minutes

Image: Decred chain is adding ~180 MB per month

Image: The full Decred blockchain can fit in modern smartphone’s storage

Image: Monthly DCR issuance in USD - rewards shifted from miners to stakers and will shift more soon

Image: Total monthly fees - Decred is still cheap to use

There are more charts now than it is feasible to show in the Journal. The above and other charts can be found here - reuse on social media is highly encouraged!

Ecosystem

New services:

-

ZEC/BTC and ZEC/USDC pairs have been launched at dex.decred.org.

-

DGB/BTC market went live. DEX client version 0.6.1 or higher is required, it can be obtained as a standalone app or with Decrediton v1.8.0. Only full node-based DGB wallet is supported initially, but built-in light wallet may become possible when DigiByte v8.22 is released.

-

Decred’s Matrix chat logs can now be viewed archive.matrix.org - a new chat archive browser replacing view.matrix.org. The service works without JavaScript and does not require a Matrix account.

Services lost:

-

Binance is leaving Canada in response to recent crypto regulations that prohibit registered exchanges from accepting stablecoin deposits or selling them to the customers without approval from CSA. Other restrictions include a ban on margin trading and investor limits. According to #trading chat customers were asked via email to close any open positions by September 30, 2023.

-

Binance plans to delist 12 privacy coins in France, Italy, Poland and Spain. Starting from June 26, residents of these countries will no longer be able to trade DCR. Binance has recently acquired appropriate licenses in the affected jurisdictions. The move came soon after the Markets in Crypto Assets (MiCA) has passed in the EU on May 16.

-

Hotbit announced it is shutting down operations and asks to withdraw all assets by June 30. DCR trading was available on the main hotbit.io since October 2019 and on its Korean branch since November 2020. According to some community members DCR was delisted some time ago and no DCR users should be affected. Reasons to sunset the exchange included: losses from the criminal investigation, outflow of funds from CEXes, unsustainable business model of trying to list too many coins of which many get hacked, and difficulties to comply with regulation. Quoting the goodbye announcement: “either embrace the regulation or become more decentralized”. We’re on it!

Other news:

-

Apparently Huobi did not delist DCR as it planned to in September 2022. The announcement page has been removed but an archived copy is available. USDT trading pairs for DCR and 6 other privacy coins from that list are still live and report good-looking volumes on CoinGecko and CoinMarketCap as of May 12. Observers from the #trading chat said that DCR has never stopped flowing back and forth between Huobi and Binance.

-

Bittrex has filed for bankruptcy in the U.S. and Malta, 3 weeks after it was charged by the SEC for operating an unregistered securities exchange. Both arms have been processing withdrawals since April.

-

Ledger announced an upcoming Ledger Recover service. Recover allows to register your ID (CA, EU, UK, US) and backup the wallet seed at trusted third parties. The seed is split into 3 fragments, the fragments are encrypted with a symmetric key and sent to 3 different backup providers. It can be later rebuilt on another Ledger device by verifying ID and getting 2 out of 3 fragments from the providers. Only Ledger Nano X is supported currently. DCR users may want to evaluate the risks of using Ledger in light of this new feature, which has been added in firmware version 2.2.1 and should be inactive until explicitly enabled. See more detailed coverage in #ecosystem.

New services discovered but not tested by the community yet:

-

DCR payment option has been spotted at fxDreema - a graphical builder of trading bots compatible with MetaTrader 4 and MetaTrader 5.

-

CryptoWallet.com features a mobile app that allows users to buy and sell crypto, supports VISA/MasterCard/SEPA transfers, and plans to launch own card product. The company is licensed in Estonia. Research and testing help is much appreciated.

Join our #ecosystem chat to get more news about Decred services.

Warning: the authors of the Decred Journal have no idea about the trustworthiness of any of the services above. Please do your own research before trusting your personal information or assets to any entity.

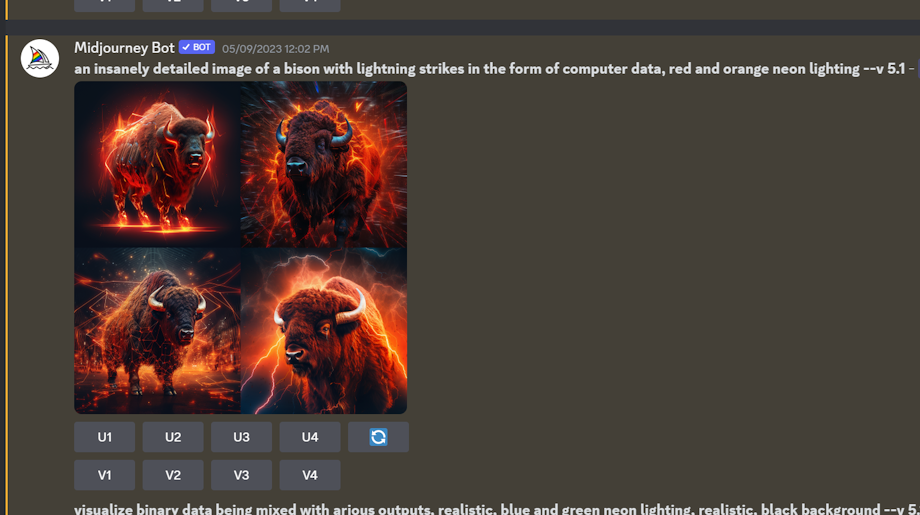

Outreach

Decred Vanguard has been approved and started its outreach operations. Vanguard has its own Discord server where members coordinate, develop best approaches and evaluate results. Members make use of Midjourney AI to generate advanced art to help get Decred’s message across. Several members acquired Twitter Blue and it seems to be working quite well. Key challenge at this point is recruiting members who are active and productive, this is why the initial monthly stipend is set low at $100. Another challenge is marketing in the bear market. In May no prizes for big/notable engagements have been allocated.

Anyone interested in joining Decred Vanguard should contact @Tivra or @Exitus. If you are new to Decred it’s OKAY - you just need to be willing to learn and help out where you can.

Vanguard really feels like something we needed for years. [@Exitus]

Image: Vanguard’s War Room

Monde PR’s achievements:

- Pitched 1 commentary opportunity

- Pitched 7 media opportunities

- Secured 1 media interview

Secured the following media placements:

- @jy-p was interviewed by Authority Magazine discussing many aspects of Decred including: Decred’s origin story, Bison Relay’s offering as a sovereign internet, upcoming support for pages and e-commerce stores, Politeia, and Decred’s use in Brazil’s election.

Events

Attended:

- @arij and @khalidesi attended EMEC EXPO in Casablanca, Morocco, a big 9K people event dedicated to digital technologies. The team had a stand where they explained Decred features to visitors from various fields, interacted with several Moroccan companies, and met some people who were already familiar with the project. See the full report here.

Media

Selected articles:

- Decred DEX launches DCRDEX 0.6, offering new levels of privacy and security for cross-chain swaps - April’s press release is now live at decred.org

- The future is now: Jake Yocom-Piatt of decred.org on how their technological innovation will shake up the tech scene by Authority Magazine feat. @jy-p

- Decred vs Horizen: Crypto is not enough! by @Joao

- I don’t want your likes by @phoenixgreen

Decred Magazine engagement stats for May 2023:

- Total number of articles on DM: 460

- Newsletter subscribers: 100

- New DM posts and newsletters sent: 16

- Active social media campaigns: 57

- Completed social media campaigns: 41

- Social media posts: 172

- Likes: 1,180

- Re-tweets: 302

- Social media followers across all platforms and accounts (including @DecredSociety): 1,350

Videos:

- Completing a Litecoin atomic-swap - DCRDEX 0.6 by @phoenixgreen

- Decred Recap - v1.7.7 improvements, atomic-swap DEX v0.6 - The DAO evolves! by @Exitus - also as a podcast

- Bison Relay upgrades to version 0.1.7 by @phoenixgreen - also as a text post

- Decrediton proposal voting by @phoenixgreen - also as a text post

- Bison Relay pre-paid invites by @phoenixgreen - also as a text post

- Decred is developing a mesh network for its DEX TikTok by @DajanaDcr and @Exitus

Livestream:

- State of the Market - Decred Vanguard - A new outreach effort by @phoenixgreen and @Exitus joined by @Tivra and @h3la1 - also as a podcast

Audio:

- Twitter Space Decred x Zcash community discussion with @Tivra and ZecHub - also on YouTube

- Twitter Space with @Tivra and W0wn3r0

Art and fun:

- Bison Ordinals inscription by @c12hz

- Ascend to Greatness by @OfficialCryptos

- Decred Katana by @OfficialCryptos

- Decred Magazine illustration by @aithzakaria1

Image: Decred shedding the ballast. By @OfficialCryptos.

Translations:

- Internet privacy and why it is important - in Chinese by @Dominic

- Decred Journal April 2023 was translated to Chinese by @Dominic - thank you!

Markets

In May DCR was trading between USDT 15.19-20.59 and BTC 0.00056-0.00075. The average daily rate was $17.13.

Community’s DCR price analysis posted in the #trading chat:

Image: Odd price wicks on DCR/USD seem to happen during low correlation with BTC/USD price action. Analysis by @saender.

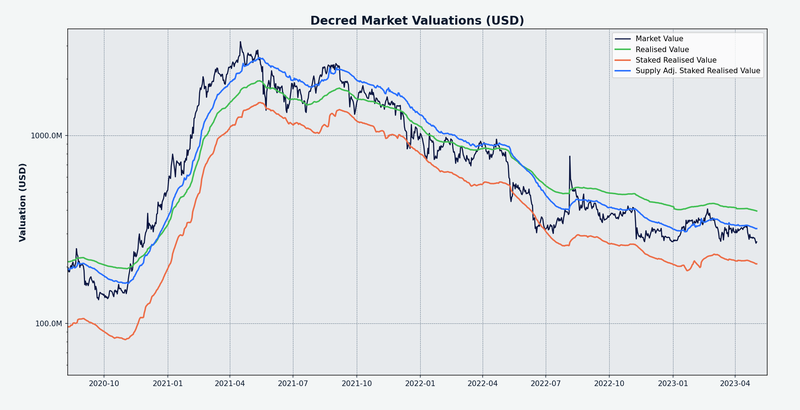

Image: Market Valuations (USD) based on Decred-specific Staked Realised Value metric from @bochinchero

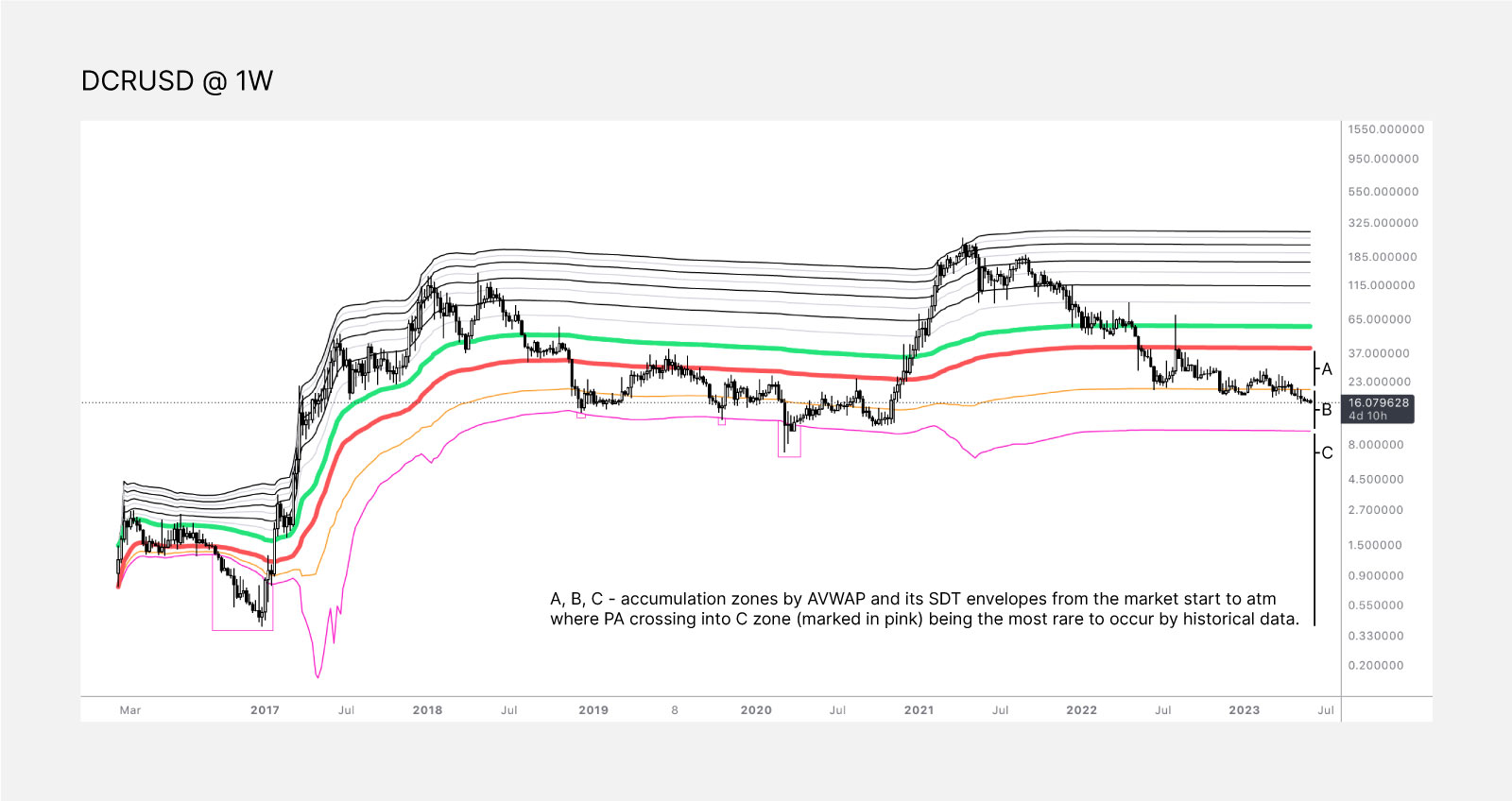

Image: DCR/USD accumulation zones analysis by @saender

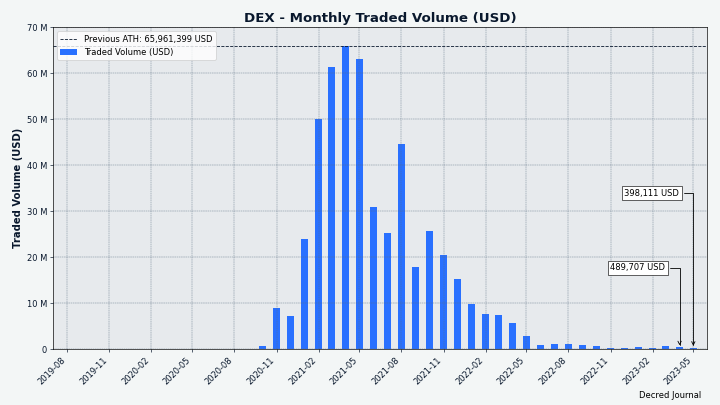

Image: DCRDEX monthly volume in USD

Relevant External

Ethereum’s Beacon chain has been experiencing some issues with finality, two episodes where validators mostly stopped proposing attestations for about an hour and nobody is sure why. Transactions on the Ethereum network have been able to continue and so users may have noticed no issues, but behind the scenes the beacon chain which finalizes everything was not working so these transactions were more susceptible to reversion than would have ordinarily been the case. Ethereum core developers released patches for the two clients affected by the issue (Go-based Prysm from Prysmatic Labs and Java-based Teku from ConsenSys), which had been caused by exceptionally high load on the nodes running these clients.

The Dash network and chain stalled on May 22 for 16 hours, due to a glitch caused by the upgrading the BLS threshold cryptography to an industry standard in v19. The core team produced a quick patch (v19.1) to halt deployment of v19 and this allowed the network to resume after 16 hours of downtime. A fix for the issue and another attempt to deploy the changes will be included in v19.2.

Halborn has documented several issues discovered while auditing the Dogecoin codebase, but which also apply to a number of forks of the same Bitcoin lineage, including Litecoin and Zcash. They refer to these as “The Rab13s Vulnerabilities”, and the most exploitable ones would allow attackers to take nodes offline, with others allowing remote code execution but only with valid credentials, making exploiting the issue more difficult.

The new BRC-20 token standard for Bitcoin inscriptions (NFTs) which was launched in March has reached a combined (notional) market valuation of $1 billion. This milestone was reached after ORDI, the first BRC-20 token, was listed on some major exchanges.

Bitcoin has set a new record in daily transactions. The trend of minting fungible tokens with the BRC-20 standard is spreading to Litecoin and Dogecoin chains, similarly raising their transaction activity levels.

There has been some criticism of the inefficiency of storage of the BRC-20 data on-chain, suggestions that not spending the time to encode data as binary is costing 4x as much in transaction fees. The choice was apparently made due to a desire to have the on chain data be human-readable, but there are suggestions that using a lot more block space may have been deliberate on the part of the designers.

Taproot Assets v0.2 was released, adding a set of tools that developers can use on testnet to issue, transfer and discover assets on the Taproot Assets Protocol (formerly Taro). Taproot Assets Protocol is aiming to provide a more scalable way to handle assets on the bitcoin chain by handling most transactions off-chain, as opposed to Ordinal inscriptions which use block space in an inefficient manner and cause a material increase in fees for all users of the network. Version 0.2 adds support for “virtual Partially Signed Bitcoin Transactions” (vPSBTs), which will allow developers to more easily handle Taproot Assets. Lightning network support for assets and stablecoins is one of the big targets for a future release, geared towards use in emerging markets.

Richard Heart’s Pulsechain (an Ethereum fork), which is a long anticipated part of the HEX ecosystem, launched, along with “PulseX” decentralized exchange (a Uniswap fork). These launches have been much anticipated by the HEX community, since years before they pivoted to become forks of Ethereum software. However the aim of lowering fees for HEX users does not seem to have been met, because of the lengthy sequence of transactions required to bridge assets to and from Pulsechain. Furthermore, significant liquidity issues made it difficult for users to obtain PLS that they could use to pay gas fees, resulting in many users being stuck without the right kind of tokens to use the network at all and these only being available at extortionate mark-ups. The prices for all the related tokens have been in a steep decline.

DeFi lending protocol AAVE approved and deployed a change to its smart contracts on Ethereum, Polygon and Avalanche networks, the change was intended to adjust interest rate calculations but, due to a function formatting error, broke the protocol on the Polygon chain. User funds worth around $120M were unavailable while a proposal to fix the error worked its way through the governance process, taking around a week to resolve the issue.

The DAO for development of OFAC-sanctioned ETH mixing service Tornado Cash was taken over by a hacker who granted themselves 1.2 million TORN tokens and used these to approve spends from the DAO’s Treasury fund. The code to allow the hack was recently passed within a legitimate-looking proposal which was approved by the usual Tornado DAO governance process. The hack did not affect the Tornado Cash mixer itself, but rather the smart contracts associated with the DAO. After a few days the attacker made a proposal to reset the changes they had made and return the unspent tokens they had granted themselves, returning control to the DAO after pocketing around $900,000 of ETH mixed through Tornado Cash.

Binance has been compiling lists of “no-progress projects” which it has listed for trade, and has started adding them to the “Innovation Zone”, on a pathway to delisting if they don’t start demonstrating some progress. CZ has already realized that this may necessitate a re-naming of the “Innovation Zone”.

Bittrex filed for bankruptcy in Delaware but with a plan to reimburse all customer asset deposits, with the global Bittrex entity seemingly unaffected.

Silvergate Capital has been delisted from NYSE and gone into liquidation. It is the parent company of Silvergate Bank, once the largest crypto banking partner. Silvergate bank was wound down in March after a rush of customer withdrawals following the collapse of FTX meant they made a loss of $1 billion in the last quarter of 2022.

Ledger hardware wallet has been recovering from a PR fail of the messaging around a new seed backup feature, Ledger Recover. The ex-CEO added fuel to the fire when he addressed concerns about seeds being exported by the new firmware by stating that users were already trusting Ledger to not deploy this kind of backdoor seed-exporting firmware, so he couldn’t see the big deal.

The finance ministers of the EU’s Council have signed off on the Markets in Crypto Assets regulation (MiCA), meaning that its provisions will come into force in June or July 2024. MiCA will require crypto firms to seek licenses to operate in the EU, and sets requirements like reserve holdings for stablecoins. Alongside MiCA some new measures were agreed to mandate sharing of information about crypto holdings of EU citizens with tax authorities.

A supply chain attack from 2022 with a tampered Trezor device has been documented. The user bought the device from an online marketplace and their crypto disappeared about a month after they started using it. Upon inspection some dodgy firmware had been installed which would cycle between 20 pre-set seeds rather than generating a random seed, and would only use the first character of any password set - so that the device could only generate 1,280 different private keys, a manageable number for the attackers to watch.

Ishan Wahi, the Coinbase manager accused of insider trading to profit from new listings was sentenced to 2 years in prison after pleading guilty. Wahi provided the information to his brother and another man, who made over $1 million trading on the information. Wahi’s brother pleaded guilty in September to conspiracy to commit wire fraud, and was sentenced to 10 months in prison.

That’s all for May. Suggest news for the next issue in our #journal chat room.

About

This is issue 59 of Decred Journal. Index of all issues, mirrors, and translations is available here.

Most information from third parties is relayed directly from the source after a minimal sanity check. The authors of the Decred Journal cannot verify all claims. Please beware of scams and do your own research.

Credits (alphabetical order):

- writing, editing, publishing: bee, bochinchero, Exitus, jz, karamble, l1ndseymm, phoenixgreen, richardred, zippycorners

- reviews and feedback: davecgh

- title image: Exitus

- funding: Decred stakeholders